Transit Costs Project Final Report

1. Introduction

We have most recently updated this report on 02/11/2023.

1.1 The issue of infrastructure and transportation

The idea of creating a mass public works program in the United States to build useful infrastructure is a popular one in 21st century politics. After some small starts in the Obama administration and the Trump Administration’s constant attempts at Infrastructure Week, the Biden Administration’s Bipartisan Infrastructure Law (BIL) converted this enthusiasm for infrastructure into law. BIL calls for nearly one trillion dollars in spending between fiscal year 2022 and fiscal year 2026, more than $500 billion will go to transportation, including $66 billion to mainline rail and $39 billion to other public transit (National Association of Counties 2022); with the usual five-year appropriations included, between $91 and $108 billion is to be spent on non-mainline public transit (FTA n.d.).

With such large sums at stake, it is critical to spend money productively. The reason governments spend money on infrastructure, transportation, and public transit rather than just giving people money as welfare is that these investments are framed as opportunities to improve connectivity, stimulate economic activity, rebuild old infrastructure, reduce emissions, create good paying jobs, and catalyze innovation (The White House 2022). Unfortunately, as we show in the rest of this report, the United States has among the highest transit-infrastructure costs in the world. Fortunately, as we also show, it can realign its institutional practices to match those of high-efficiency, low-cost countries like Sweden, Italy, and Turkey.

1.2 Why we study rapid transit

Building rapid transit is unusually valuable for governments, as subways, metros, and light rails operating at high frequencies generate economic value by permitting urban growth. Bunten (2017) argues that solely building more housing in congested, high-demand cities like New York and San Francisco carries a benefit of 1.4% of GDP. This finding is more muted than Hsieh and Moretti’s (2015) 13.5% benefit estimate. Bunten assumes a static transportation network since construction costs in those cities are so high; thus, more population equals greater congestion, which dampens the effect of development on the economy and introduces a negative traffic externality.

In an environment where transportation networks can grow with the city, the gains from development would be closer to those in Hsieh and Moretti; put in other words, the economic gains from being able to build dense urban transportation networks are likely to be about 10% US-wide.

These dense transportation networks have to be rapid transit-based. This is partly for environmental reasons—in a dense city, it’s especially important to have low-pollution transportation. But it’s also true in a future world where all cars may be electric. It is not possible to outdo the subway in capacity per amount of land consumed—and in a high-demand city, 12-lane freeways are prohibitively land-intensive. Hook (1994) argued that Japan focused on rail transportation in its largest cities because it had high land values in the postwar era and such strong property rights that widespread land condemnation for freeways based on the American model was impossible.

Thankfully, urban rapid transit is especially amenable to comparative research, because of its scale. Each line or phase is a large undertaking by itself: a single project routinely runs into the billions of dollars. This means that each project is itself the object of debate and media coverage. Relying on media reports and official government sources, we can get access to reliable data on the construction costs of a large majority of urban rapid transit lines in the world. We can likewise obtain costs for other megaprojects, such as high-speed rail.

In contrast, the vast majority of roadwork projects are small. A state’s road budget is typically split among many projects. Megaprojects for roads exist—for example, the $1 billion Sepulveda Pass Improvements Project in Los Angeles—but only cover a small share of overall spending. The more typical investment in roads is a bypass here, a new interchange there, and a widening yonder, all repeated hundreds of times to produce hundreds of billions of dollars in roadway expansion per six-year transportation bill cycle. Headline costs for these projects may not be readily available, and when they are they often include too many unrelated extra side projects to be useful to compare.

The difference between roads and urban rail extends beyond data collection. An engineer in Los Angeles who has worked on both road and rail projects explained to us that American road projects are essentially commodities (Personal Interview 2020). For example, a new public parking garage would be one of thousands of such structures built, which means that the costs and risks are well-known. It is also a simple project—just a parking garage. In contrast, an urban light rail or subway line, besides being one of dozens in the last generation rather than thousands, has many distinct parts: the civil structures, the tracks, the signaling system, the maintenance facility, the rolling stock. Far more prior planning is needed in the latter case, and the engineer told us that Los Angeles County’s preference for outsourcing planning to private consultants with little public oversight works well for simple projects like parking but not for more complex ones like urban rail. To maximize the quality of rail investment, it is valuable to compare the efficiency of infrastructure for rail and not for higher-cost but institutionally simpler roads.

1.3 Why costs matter

We started the Transit Costs Project to understand how to reduce the costs of transit-infrastructure projects in the United States and other high-cost countries so that we can build more transit infrastructure. In significant parts of the United States, there is political consensus behind the need to improve the state of public transportation. The reasons for this vary, but can include any of the following:

- A green desire to decarbonize the transportation sector, reduce air pollution and car crashes, and undo the postwar trends of suburban sprawl and mass motorization.

- An association between the prosperity of a central city like New York or Boston and the strength of its subway system.

- Present-day limits of freeway-centric transportation such as traffic congestion and downtown parking scarcity.

This is by no means a national consensus. But it is a consensus in most of the largest cities, including those of the Northeast and the West Coast, as well as Chicago. But despite this consensus, there is little movement on the construction of expansive urban public transit. Even projects that enjoy wide political popularity move slowly. As costs creep higher, timelines drag on, and promises aren’t kept, as we will see in the Green Line Extension (GLX) case, the public loses faith in transit agencies’ ability to deliver high-quality infrastructure at a reasonable price. Moreover, in places and among political movements that lack any consensus for mass transit investment, the high costs of construction on the East Coast and California are a common argument against investment.

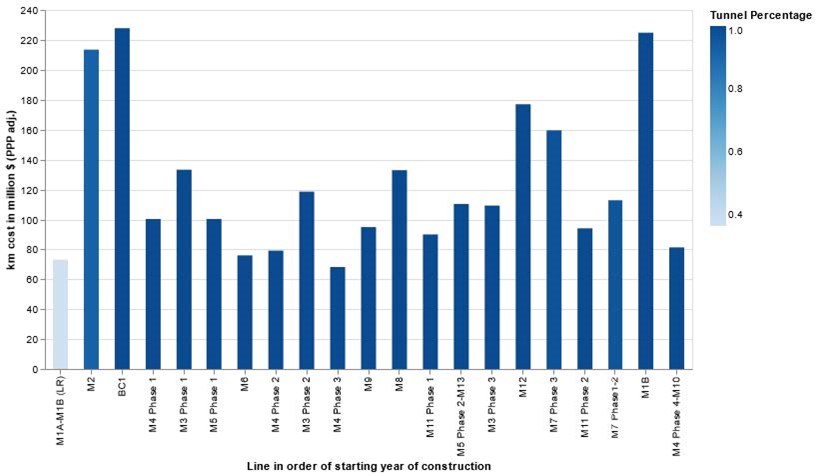

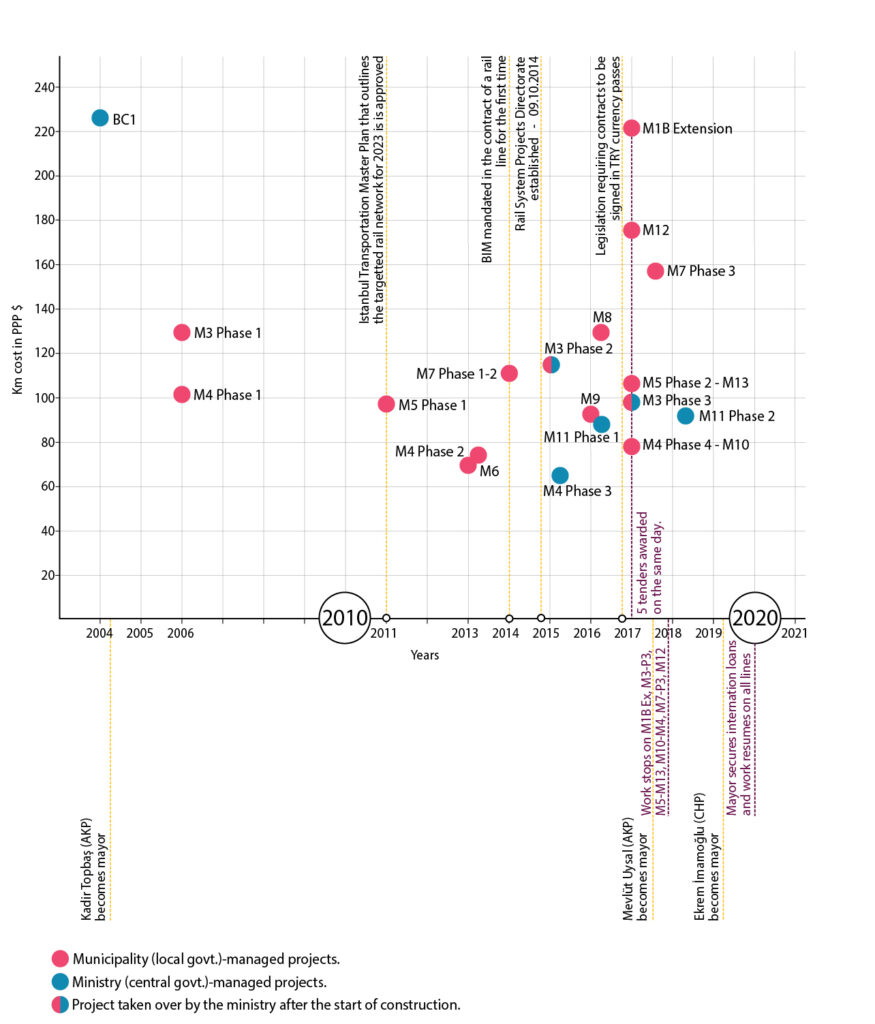

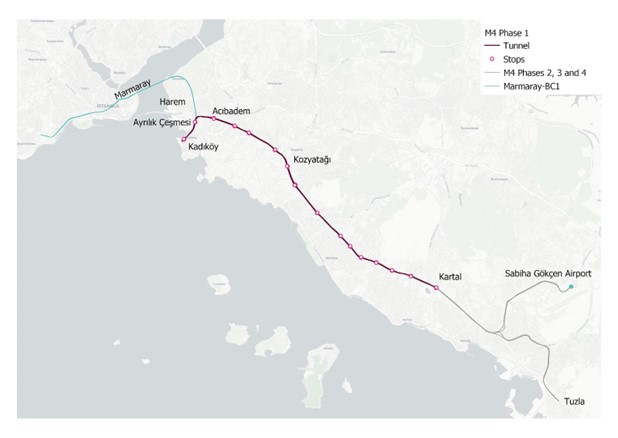

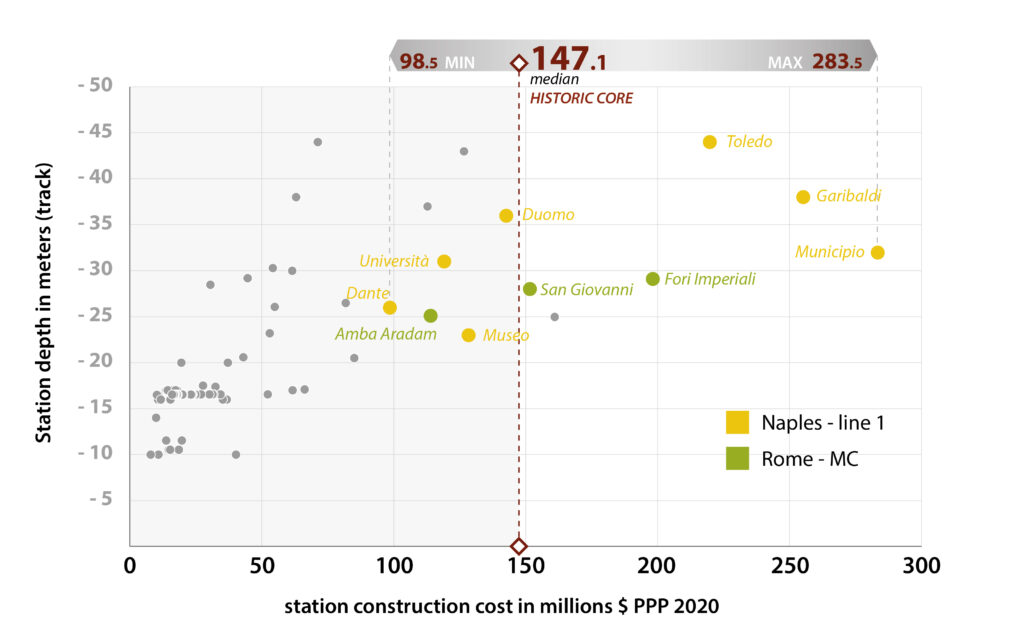

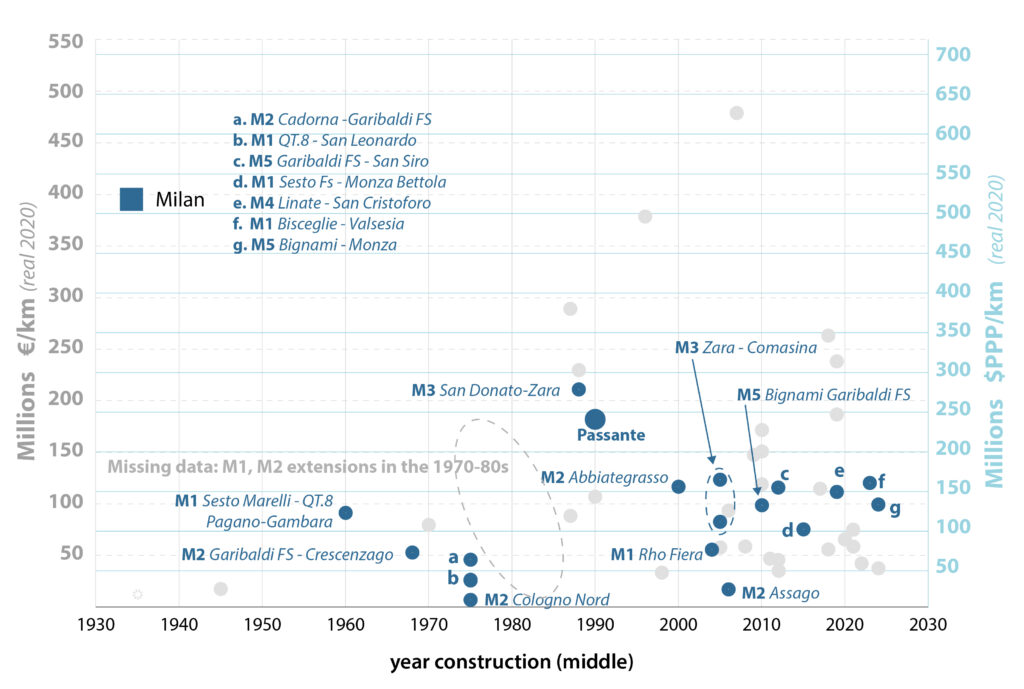

The problem of high costs is nationwide. According to our database (Transit Costs Project n.d.) of more than 900 projects in 59 countries, including Hong Kong, the United States is the sixth most expensive country in the world to build rapid-rail transit infrastructure.[1] This is slightly misleading, however, because construction costs scale with the percentage of tunneled track, which is more expensive than building rail at grade. The five countries with greater average costs than the United States are building projects that are more than 65% tunneled. In the United States, on the other hand, only 37% of the total track length is tunneled (Figure 1).

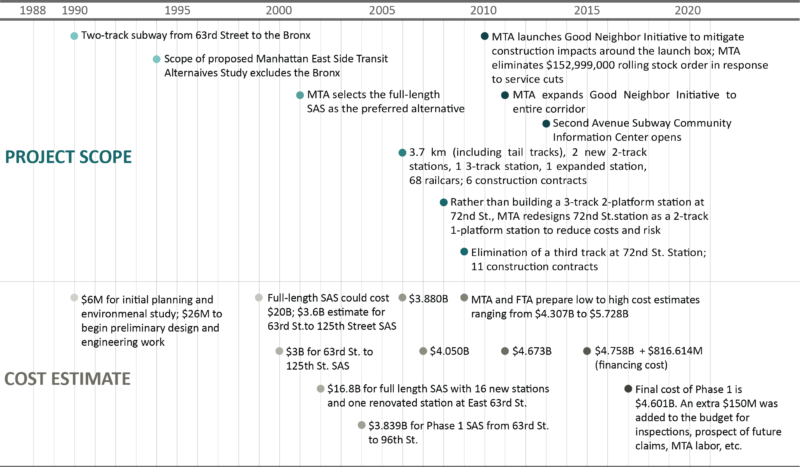

figure 1. Average Cost per Kilometer by Country.

Nonetheless, the bulk of American rail construction occurs in the context of broad local political support, and even then, long-term planning is not strong and the outcomes are poor. Therefore, it is valuable to understand what it is about the physical, institutional, and social situation of American cities that frustrates subway expansion dreams.

1.4 The Cost Premium, in Brief

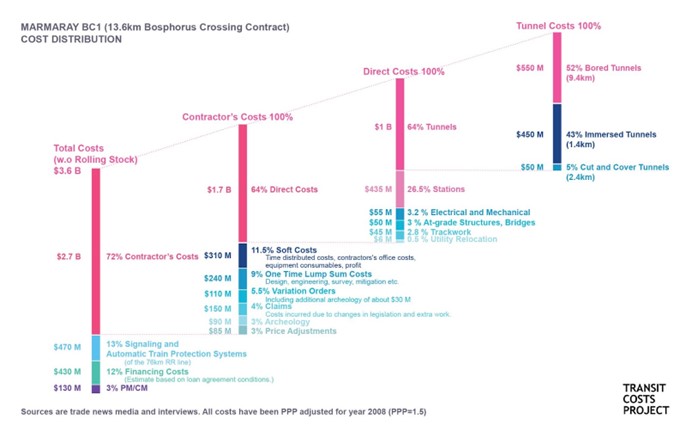

Based on our detailed case studies and data collection, we identified three primary factors that comprise total project costs and explain why Phase 1 of New York’s Second Avenue Subway is 8 to 12 times more expensive than our composite baseline case. Our baseline case draws on detailed cost data from our Italy, Istanbul, and Sweden cases, and is informed by data from medium-cost Paris and Berlin and low-cost Helsinki and Spain. The New York premium is based primarily on detailed cost data from our Second Avenue Subway case study, and is supported by data from our GLX case and data from London and Toronto.

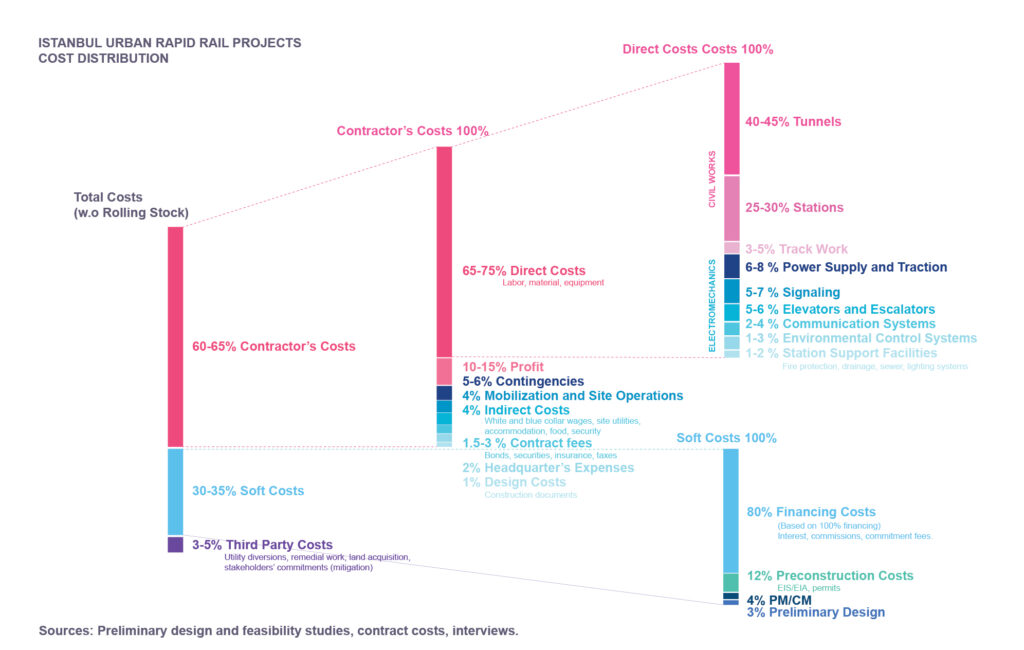

The three primary factors are as follows: Physical Structures, Labor, and Procurement and Soft Costs. The Physical Structures factor can be broken down into two additional factors: Stations and Tunneling, and Systems and Standardization. Since we are working backwards from contracts rather than building up from line-item costs, our disaggregation of the data relies on these three synthetic factors rather than traditional cost categories like materials, equipment, and labor; the Procurement and Soft Costs factor affects all such categories at once. We have also combined procurement and soft costs into one factor, because in the emerging design-build norm in the English-speaking world, which postdates Phase 1, they cannot be distinguished. The factors are multiplicative, so that various premiums of 25-50% compound to produce an order of magnitude difference.

Below we detail how we developed our factors, and show how the New York premium grows relative to the baseline (Figure 2). This is in relative units, the baseline representing the aggregate of our low-cost comparison cases.

figure 2. New York Cost Premiums.

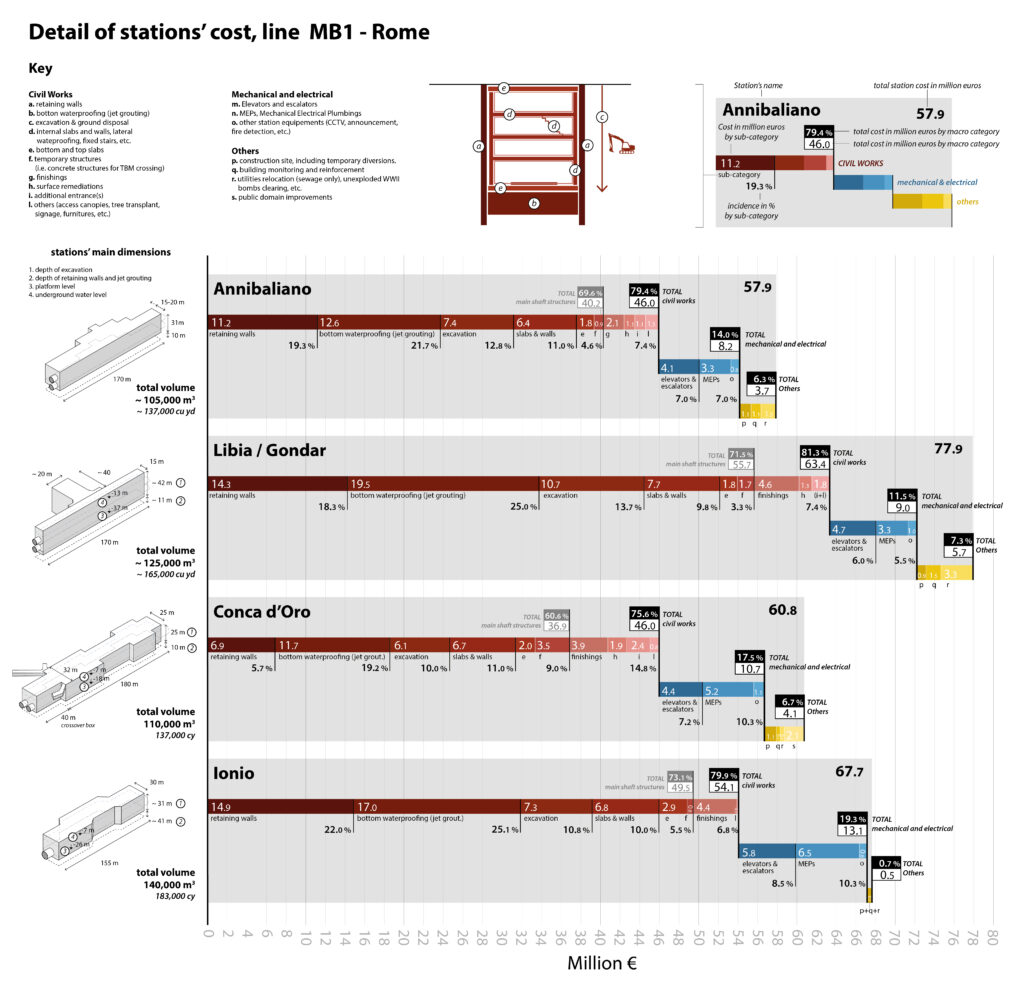

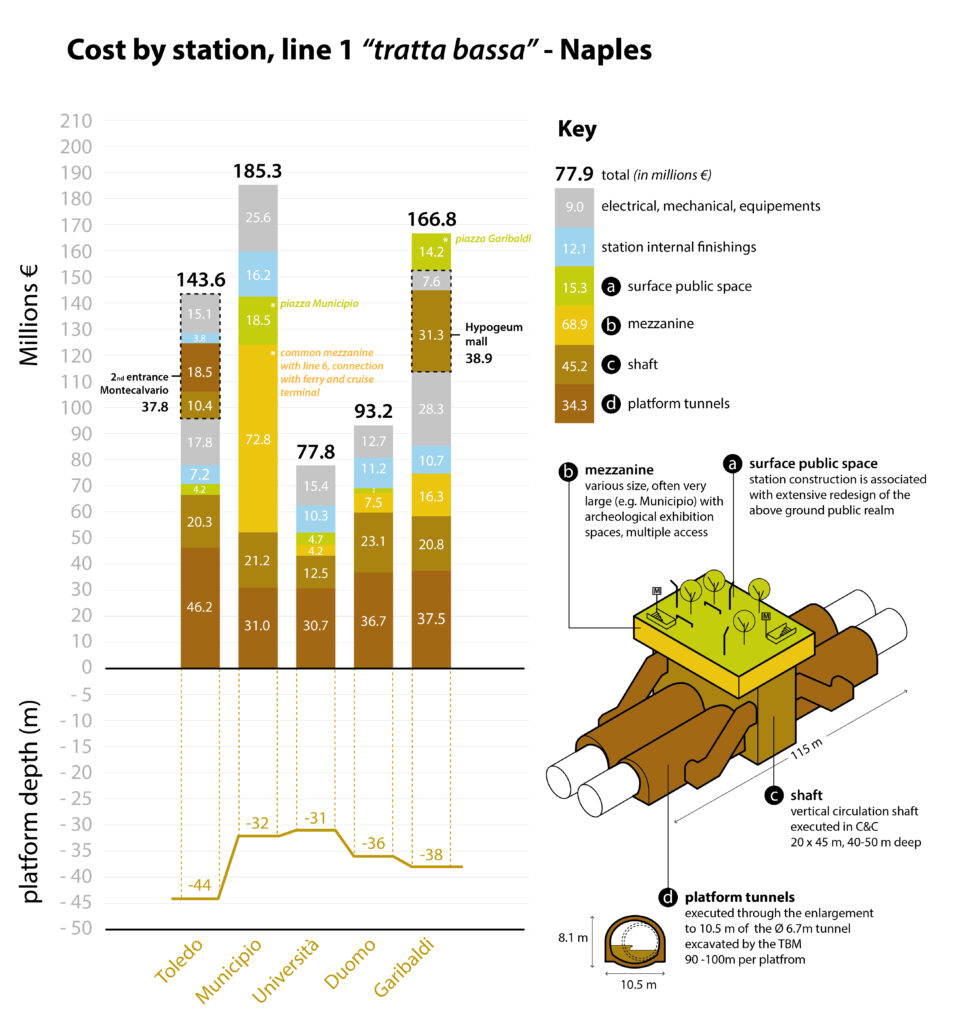

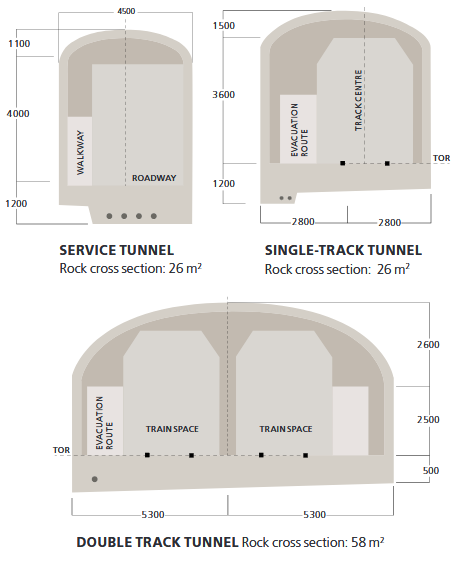

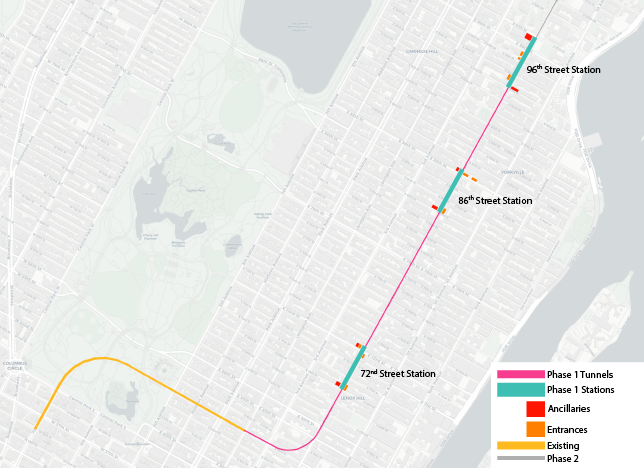

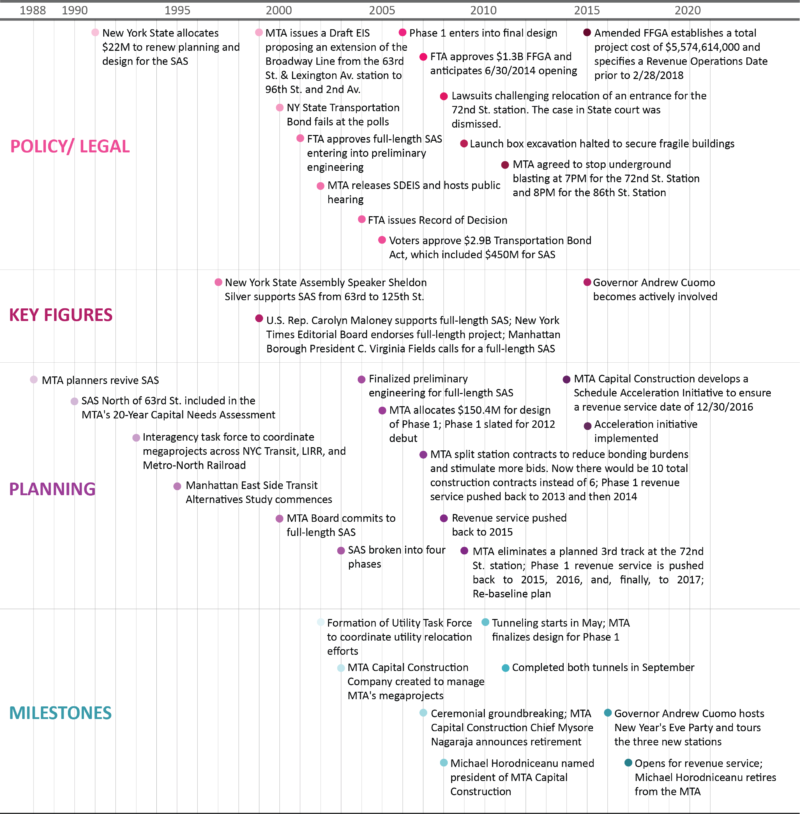

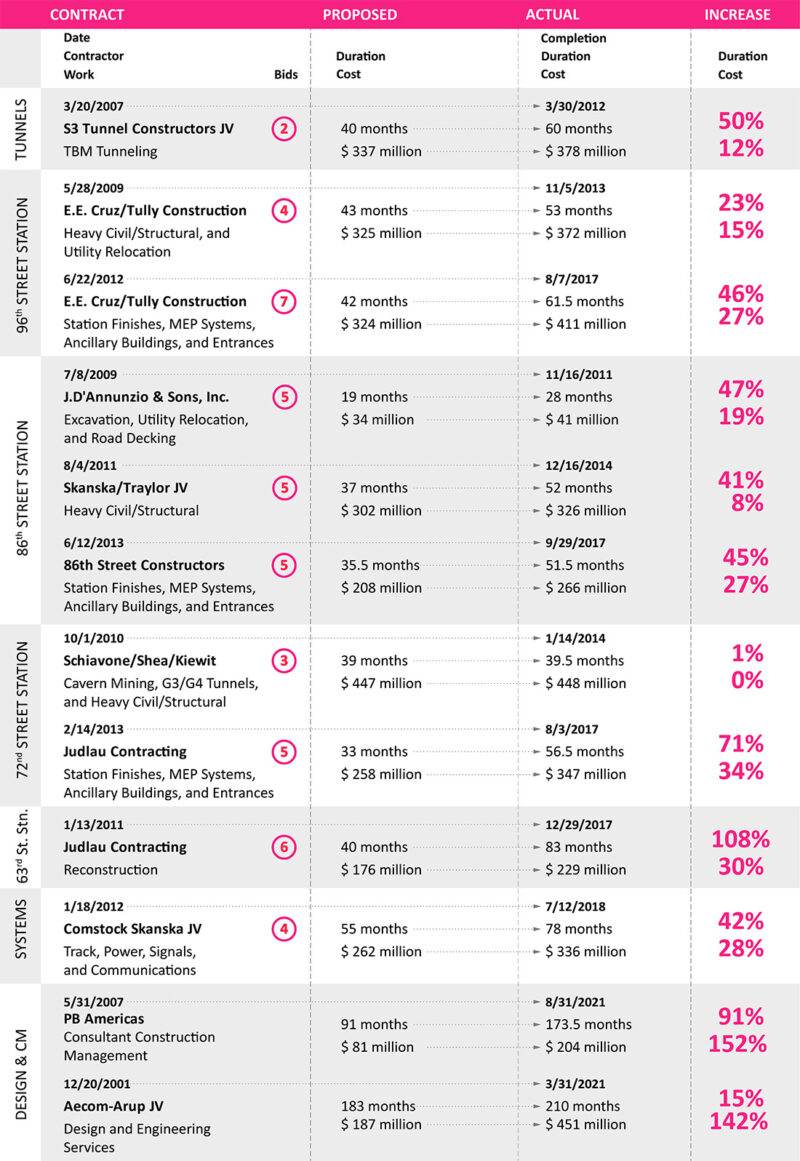

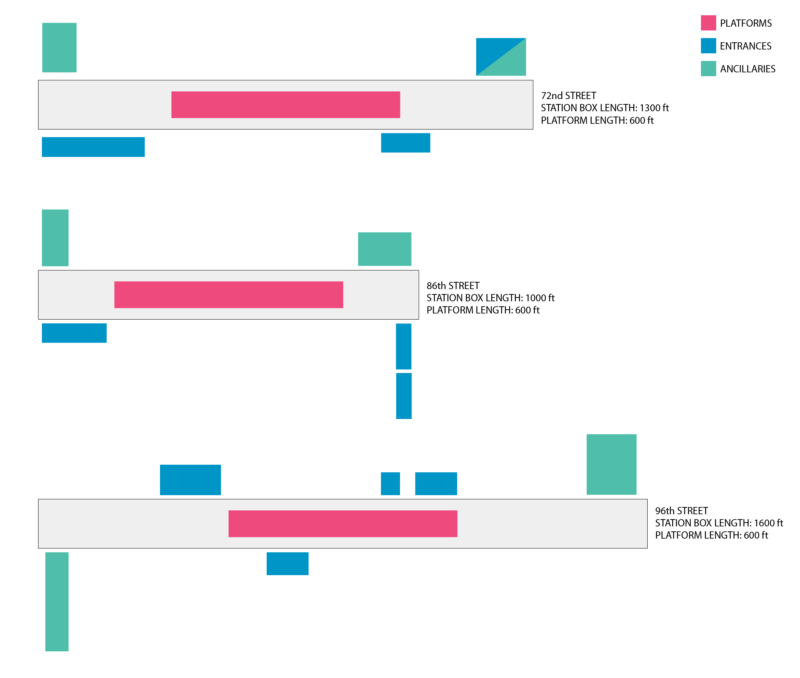

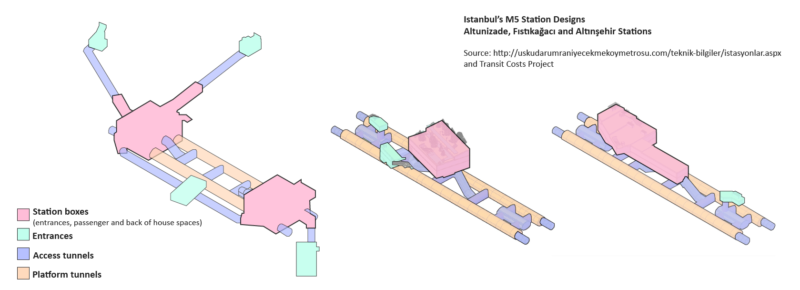

Physical Structures (Stations and Tunneling): New York’s subway station construction methods, by themselves, led station costs to triple through overbuilding. One of Second Avenue Subway’s three station digs, 96th Street, is 2.6 times longer than its 187 meter platform; the other two stations are about twice as long as the platforms, but have significantly higher costs per cubic meter than 96th Street, because of the use of a more expensive deep mining construction technique. In our comparison cases, station digs were 3-20% longer than the platforms. As 77% of Second Avenue Subway’s hard costs were stations, the rest going to the tunnels between them and systems, this by itself more than doubled costs. Finally, some utility and interagency conflicts are absorbed as overbuilding. Overall, the oversize stations alone raise project costs by a factor of 2.06.

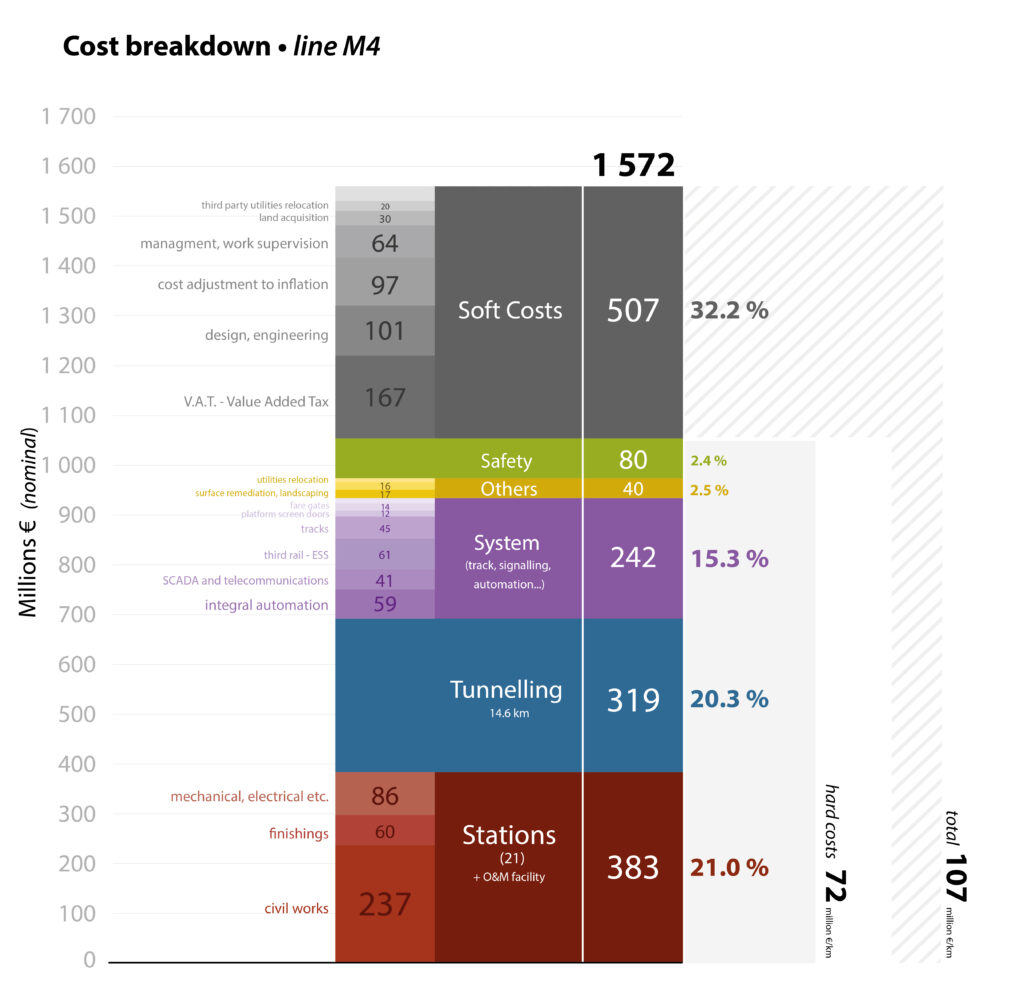

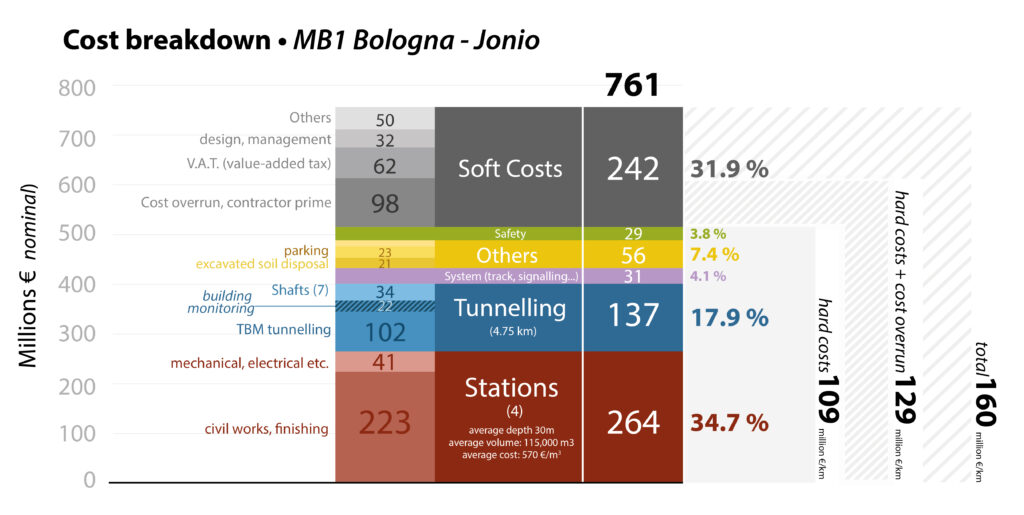

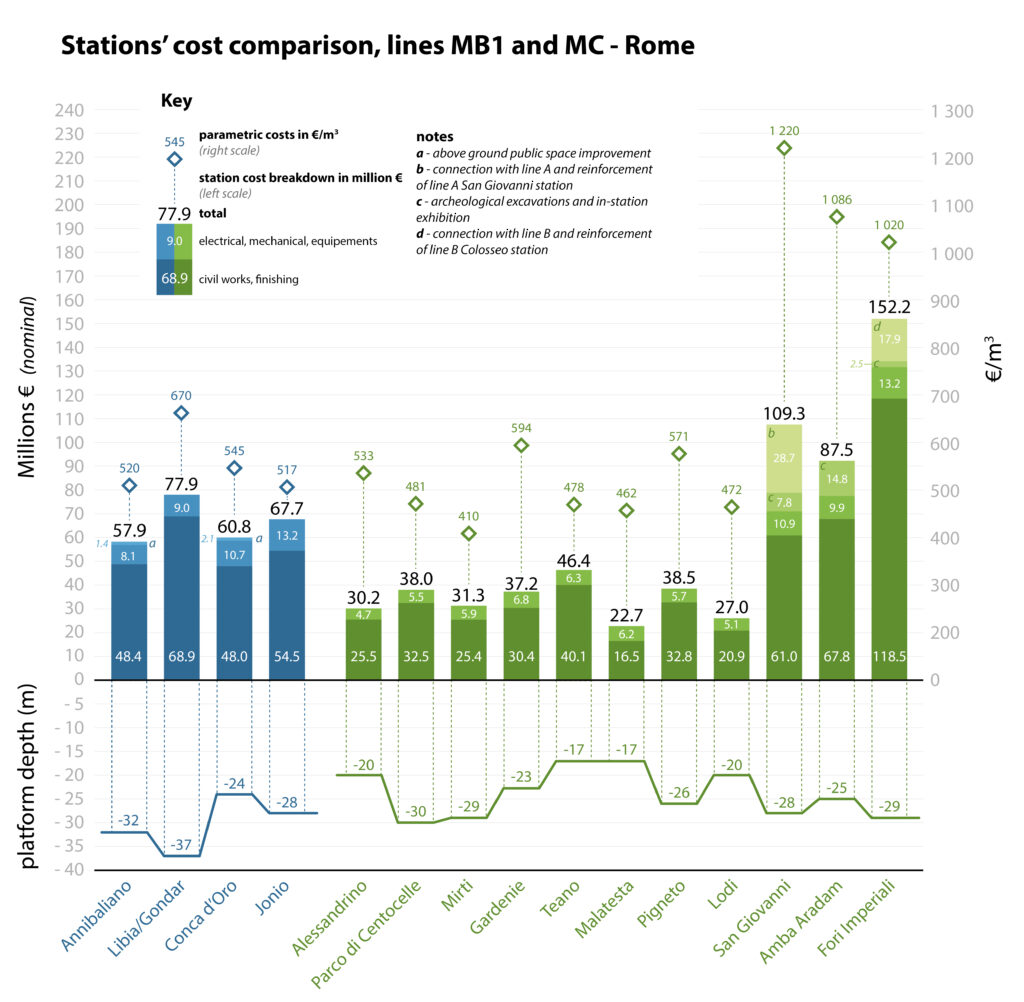

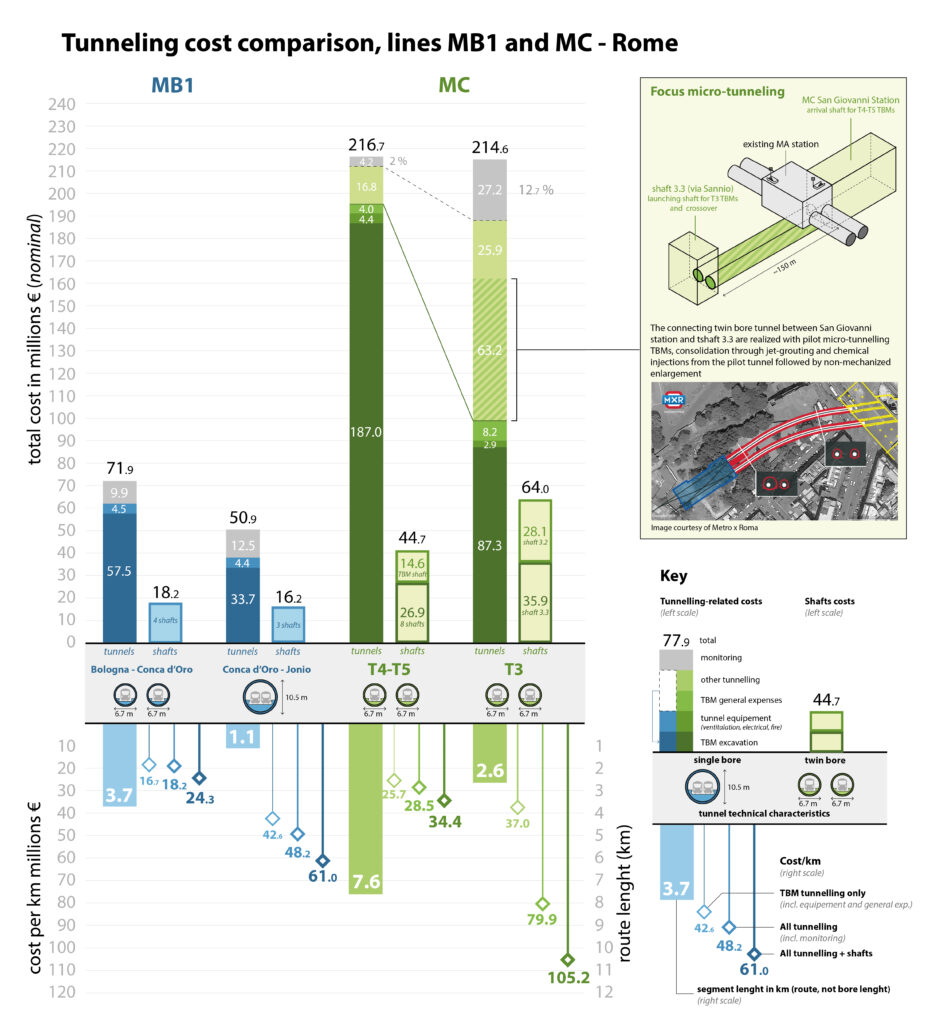

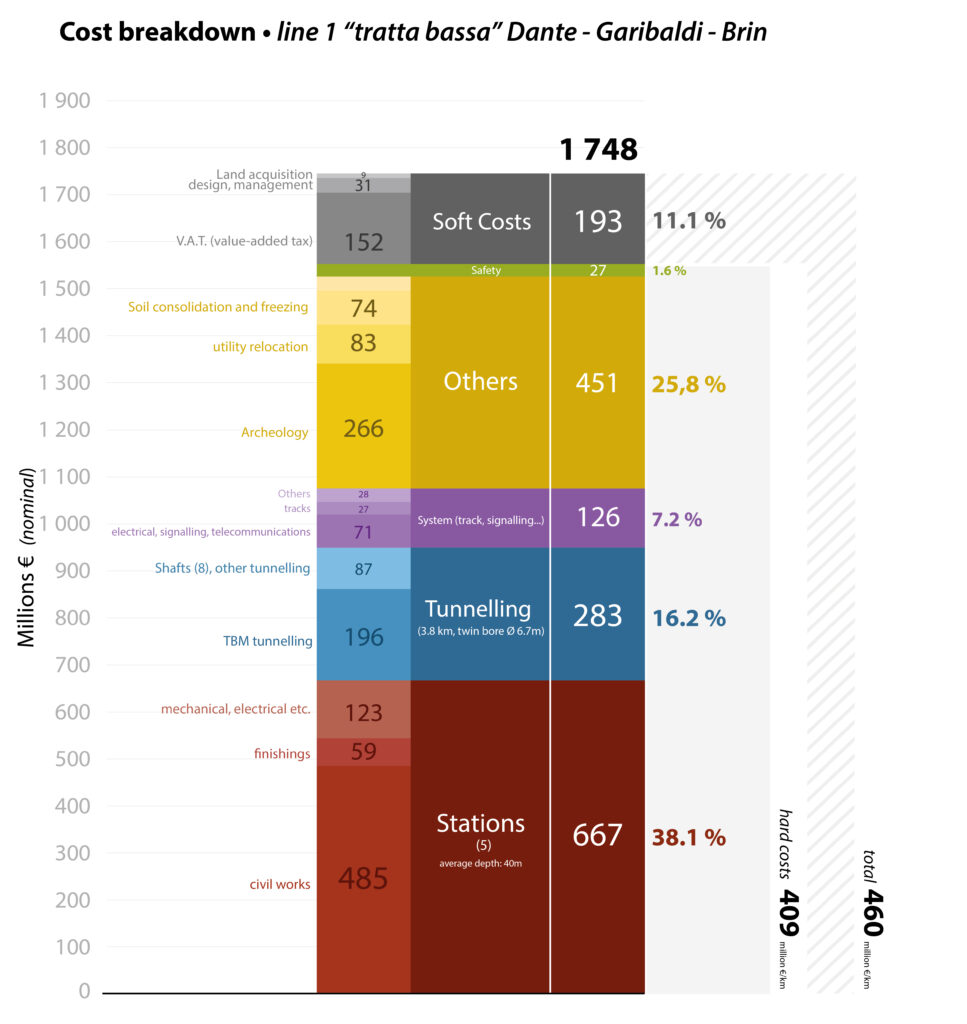

Physical Structures (Systems and Standardization): A lack of design standardization leads to fewer economies of scale, the inability to replicate station designs quickly without incurring more design costs, and makes it difficult to apply lessons learned from one station to another during the construction process. The stations for the original GLX project and for Phase 1 of the Second Avenue Subway were bespoke rather than standardized; for example, Phase 1’s three stations used two different escalator contractors and have a different number of exits, crossovers, and elevators, all of which raise design costs because each station needs to be customized rather than using a standard design that is modified slightly. Overall, systems and station finishes cost $1.36 billion for Second Avenue Subway compared with $1.57 billion for tunnels and station civil works, a ratio of 46.5:53.5.[2] In Paris, the approximate ratio of systems to tunnel costs is 15:40; in our Italian case we found that exact ratio for station finishes and systems to civil infrastructure costs for Rome Metro Line B1, and the station procurements we have seen in our Swedish case appear similar in ratio. Together, the difference between a 15:40 and a 46.5:53.5 ratio suggests that systems costs could be reduced by a factor of 2.3, which would reduce overall hard costs by a factor of about 1.35.

Labor: In New York as well as in the rest of the American Northeast, labor is 40-60% of the project’s hard costs, according to cost estimators, current and former agency insiders, and consultants with knowledge of domestic projects. Labor costs in our low-cost cases, Turkey, Italy, and Sweden are in the 19-30% range; Sweden, the highest-wage case among them, is 23%. The difference between labor at 50% of construction costs and labor at 25%, holding the rest constant, is a factor of 3 difference in labor costs, and a factor of 1.5 difference in overall project costs. This is because, if in the Swedish baseline an item costs $25 for labor and $75 for the rest, then in the Northeast, to match the observed 50% labor share, labor must rise to $75, driving overall costs from $100 to $150. In our New York case, we show examples of redundancy in blue-collar labor, as did others (Rosenthal 2017; Munfah and Nicholas 2020); we also found overstaffing of white-collar labor in New York and Boston (by 40-60% in Boston), due to general inefficiency as well as interagency conflict, while little of the difference (at most a quarter) comes from differences in pay.

Procurement and Soft Costs (Procurement): We have identified numerous cost drivers that stem from procurement norms in the United States. These include a pervasive culture of secrecy and adversarialism between agencies and contractors, a lack of internal capacity at agencies to manage contractors, insufficient competition, and a desire to privatize risk that leads private contractors to bid higher. Overall, this raises costs by a factor of 1.85, with the extra money going to red tape, wasted contingencies, paying workers during delays, defensive design, and, owing to contractor risk, and profit. Moreover, many ongoing reforms hailed as steps forward, which we call the globalized system in the Sweden report, at best do nothing and at worst are actively raising costs; these reforms all aim to privatize risk and have been popular throughout the English-speaking world, and while consultants, managers, and large contractors like them, costs grow sharply wherever they are implemented, such as England, Singapore, Hong Kong, and Canada.

Procurement and Soft Costs (Soft Costs): Soft costs include design, planning, force account, insurance, construction management, and contingencies; breakdowns differ by city. Nonetheless, we harmonized definitions around third-party design, planning, and project management costs. Those add 5-10% on top of the hard contract costs in our comparison cases, most commonly 7-8%. But in English-speaking countries, soft costs add much more; for Second Avenue Subway, it was 21%. Moreover, this is 21% of an already inflated amount–by at least a factor of 1.5 for labor, since third-party project management costs don’t grow when contractors are overstaffed. Overall, this contributes to a New York cost premium factor of about 1.2, which we also see in other English-speaking cities. The factor has some uncertainty and may be as high as 1.3 with additional soft costs, but those are absorbed into procurement costs.

We caution that the numbers are less precise than in the above chart. For example, the factor of 1.5 premium in labor costs comes from a comparison of Northeastern American projects including Phase 1 of the Second Avenue Subway with European examples, but both sets of projects have ranges, so the actual premium ranges from 30 to 70%, where 50% is the most likely value. This is why, while the calculations look like a precise premium of 9.34, the best we can say is that the range is between 8 and 12.

The good news is that high-cost countries can adopt the practices of low-cost countries and build subways at costs more in line with those of low-cost Scandinavia, Southern Europe, and Turkey. To do this, it requires rethinking design and construction techniques, labor utilization, procurement, agency processes, and the use of private real estate, consultants, and contingencies. If it implements the best practices we detail in the rest of the overview, the highest-cost city in our database, New York, can reduce its construction costs to match those of Italy and match or even do better than Scandinavia.

[1] The total hard costs for Phase 1 were $3.16 billion. We exclude the $229 million 63rd Street Station reconstruction from this calculation because we don’t know the breakdown of civil construction versus station finishes.

[2] We continuously update our database as new data becomes available.

2. Transit Costs Project Overview

In this section, we provide an overview of our case studies and draw on our work in other cities to identify common themes across all of our research and make recommendations about how to build transit infrastructure more cheaply and quickly in the United States and other high-cost environments. While this work is comparative, we recognize that differences in accounting, project scopes, access to unit costs, and transparency make precise comparisons difficult. Despite these challenges, we believe that our in-depth case-based approach allows us to understand what drives costs in high-, median-, and low-cost projects.

To do this, we examine multiple cost drivers thematically, but every theme comes back to institutions and decision-making processes and how they influence each of the aspects we study:

- Politics and decision making

- Civil service and internal capacity

- Procurement and risk allocation

- Utilities and agency coordination

- Labor

- Cost-effective design

Physical geography, archeology, and geology also drive costs, but in the cases we have studied, low-cost countries have figured out how to deliver projects under challenging geological, seismic, and archaeological conditions. Overall, at the most general scale, it is necessary to address politics and institutions to address the downstream issues.

Practitioners in high-cost environments must be ready to learn from their low-cost counterparts, reflect on internal practices and standards, and ask both “Why do we do things the way we do them?” and “How can we adopt practices from more efficient places?”. Ultimately, lower costs can be achieved by implementing governance, civil service, procurement, and transparency reforms and using them to reduce the extent of overengineering and local extraction. None of this requires large-scale legal changes, but it does require reassessing decision-making processes, institutions, the nuts and bolts of project agreements, and getting key decision makers to support projects rather than delay difficult decisions.

2.1 Additional cases

While most of our work has gone into the five primary cases—high-cost New York and Boston and low-cost Sweden, Istanbul, and the cities of Italy—we’ve also interviewed practitioners and studied documents in other cities.

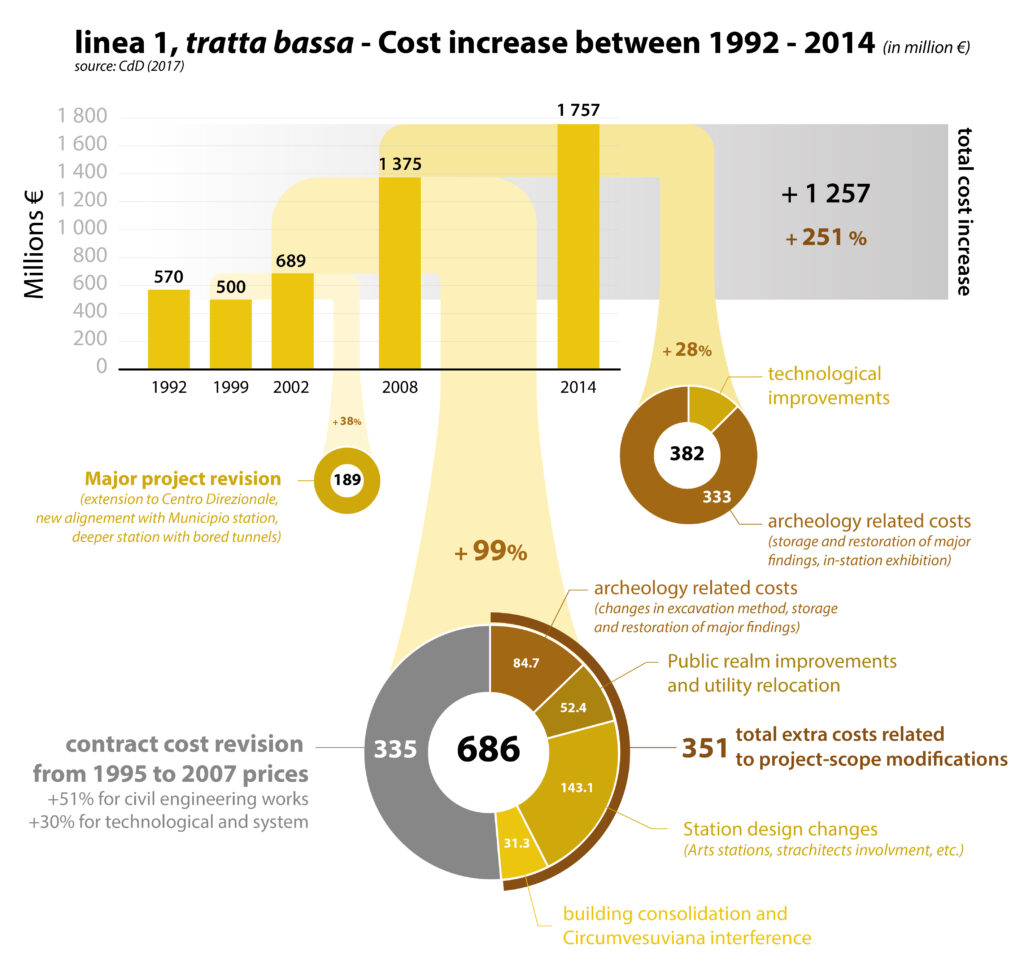

In Paris, where construction costs are roughly at the global median, we conducted six interviews and reviewed government reports to understand how one of the median-cost cases builds transit projects. While Paris’ costs are generally good, the 200 km Grand Paris Express (GPE) cost overruns have drawn severe criticism from the state’s top administrative court, the Cour des Comptes (2017). Based on our review, we have seen that French practices sometimes resemble those of low-cost Italy and other times those of high-cost America.

Additional countries and cities where we have interviewed experts, collected data, and reviewed reports include low-cost Spain, Switzerland, and South Korea; medium-cost Germany and Israel; and the largely high-cost Netherlands, United Kingdom, Philippines, Canada, Australia, Seattle, Los Angeles, and Taiwan. Among those, Spain resembles Italy and Turkey closely, and we expect that a full case study there would reveal details that differ subtly from those of Italy and Turkey but at a larger scale are institutionally similar. The others are more divergent, and we expect that full case studies there would reveal additional details and factors. Taiwan appears the most unusual: a report and an interview both blamed high costs on corruption coming from the timing of the transition from one-party rule to multiparty democracy (Personal Interview 2020).

Across the English-speaking countries other than the United States, there are some striking similarities. The institutional problems we have heard about from experts in Britain, Canada, and Australia are largely the same, and it appears that Canada, Australia, Singapore, Hong Kong, and New Zealand are imitating British practices. Moreover, the cost histories of this region are similar. Where New York began displaying a large construction-costs premium over the rest of the world in the 1930s, London only did between the 1970s and the 1990s, shortly followed by Hong Kong, Canada, and Singapore.

Imitation of British practices is also seen elsewhere: as detailed in the Stockholm case study, some of the British aspects of privatization and devolution of expertise to private consultancies are making their way to Scandinavia. We cannot definitively connect such Anglicization with higher costs, as the process is in its infancy, but the Anglicization process correlates with cost increases across countries.

2.2 Politics and decision making

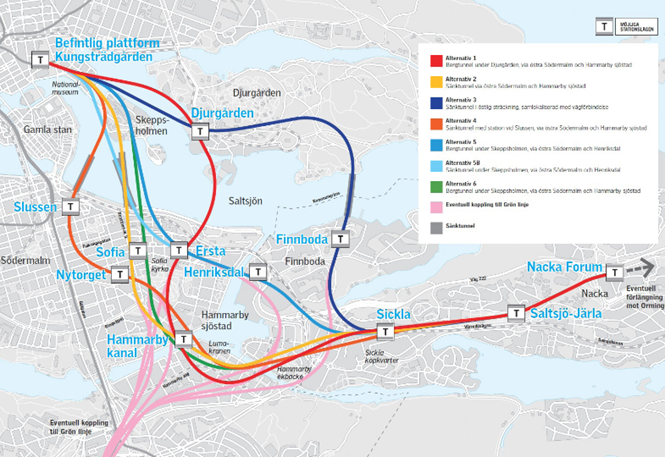

Megaproject decisions are always political, in high- as well as low-cost countries. Large megaprojects are constantly referenced in party programs in national, regional, or local elections. Moreover, even when not explicitly part of an election campaign, the decision to build a megaproject is decided at the highest level. Decisions about alignments, stations, analyses need to follow standard procedures rather than being reinvented for each project. In low-cost countries, politicians do not micromanage such technical matters, but they do macromanage and make yes-or-no decisions about building megaprojects.

While there may be political consensus that subway expansion is desirable, this does not mean there is consensus about how to go about it or which projects to support. Different political parties or levels of government may snipe at one another in order to claim credit. In Turkey, it is a political goal for the Erdoğan cabinet to deny credit to Istanbul’s opposition mayor and potential presidential challenger Ekrem İmamoğlu. Since İmamoğlu was elected, it has been more difficult to arrange loans from local banks and state approvals for international funding, which has forced İmamoğlu to issue Eurobonds to finance metro expansion.

Balancing political and professional decision making is therefore delicate. Irrespective of how a city’s construction costs compare with others’, rail projects require large budgets and necessarily concern elected officials from different levels of government. If the decision is fully depoliticized, it’s indicative of very high levels of political consensus and limited credit fights.

However, while the decision to proceed is always political, the details do not have to be. In nearly all of the low-cost examples we studied, planning and design were done by professionals, with little political input. Political will to follow through with the implementation of a sequence of projects that are part of a city’s transportation master plan has kept rail construction programs in Istanbul, Milan, and Stockholm going and helped cultivate these cities’ rail industry, despite changes in government. The medium-cost expansion programs in Paris and Berlin display little political micromanagement as well; in Paris the most significant political input since the initial decision to proceed has been the decision to continue going through with the entirety of Grand Paris Express despite cost overruns and controversy about its highest-cost-per-rider section, Line 18.

In contrast, political meddling is associated with higher costs. Just getting New York’s former Governor George Pataki to provide funding for the Second Avenue Subway involved extensive local politicking. LA Metro and Seattle’s Sound Transit board members, all locally elected officials, are even more likely to interfere and then recommend further study when it comes to selecting a contentious locally preferred alternative or managing third-party agreements (Scauzillo 2019; Giordano 2022). The United States in general displays high reliance on elected officials and political appointees relative to permanent civil service, and among the trends seen in 21st-century Canada in conjunction with rising costs is the rising politicization of decisions regarding construction methods and whom construction agency heads report to (Wickens 2020). At no point have these politicians intervened on behalf of the MTA or its American peer agencies to strike deals with obstinate utility companies, smooth over frayed interagency relationships, or weigh in on labor relations until the project was nearly complete.

The flip side of the issue of political meddling is that if there is too much political support for a megaproject, its costs are likely to rise due to the problem of early commitment. Early commitment, as identified by Cantarelli et al. (2010), means that the political decision to go forward with a project is done at too early a stage of design. Once that commitment is made, it is hard to walk away from the project, it becomes easier for external actors to extract surplus and harder for the planners to engage in value engineering or fight feature creep. The federal funding process in the United States enshrines this problem in law via the Full Funding Grant Agreement: it does not permit removing scope without time consuming appeals, paperwork, and the risk of clawing back money, but does not limit mechanisms for scope creep or delays through change orders and contingencies.

In Cantarelli et al. (2010; 2022) this is seen in cost overruns more than in high absolute costs. Medium-cost countries can have early commitment as well, leading to cost overruns from initially low levels. For example, GPE suffers from this problem: it is so politically popular that value engineering is politically difficult, which has played a factor in the decision to retain Line 18 in the program. There is also an element of early commitment in Nya Tunnelbanan cost overruns, caused by changes in regulations midway through the project that require more expensive design. Finally, in 2016, Seattle voters approved a slate of projects that were based on 1-2% design, which one former official described as “a drawing on a napkin” (Personal Interview A 2022); this ongoing expansion plan is behind schedule and over budget, but there is no hint of eliminating projects or reducing project scopes despite unforeseen challenges and rising costs (Sound Transit 2021).

The hazards of early commitment and those of political meddling are closely intertwined. Massachusetts’ Green Line Extension (GLX) suffered from early commitment: the political decision to proceed was undertaken during 2000s lawsuits and confirmed shortly after the Obama administration’s stimulus bill passed in 2009, and lacking long-term in-house planning capacity, Massachusetts rushed the early design and relied on a federal grant to complete a more detailed design. The political meddling consisted of a directive from the governor to be more accommodating of local community demands, which are a vector for how early commitment can lead to cost overruns.

Politicization in the United States also raises labor costs and leads to overdesign and overbuilding. American transportation megaprojects have a mixed mandate: in addition to being projects that produce transportation benefits, elected officials pitch them as job creators and economic development tools. For such projects, the goal is not just ridership or service, but also overall spending.

A related issue is that poor planning, cost overruns, and high absolute costs may emerge from interaction between different levels of government. The United States and United Kingdom both have a culture of tapping national pools of money: once money is made available through a national program, localities choose projects based on how to maximize the federal commitment. In the United States, even rich states like New York and Massachusetts may engage in this, and try to advance projects that are believed to be political priorities for important members of Congress, even after the bill has passed and the decision making is entirely executive.

Much of American political power is informal. At this point, planners and activists expect heavyweights (such as members of Congress) to meddle even if the heavyweights are barely even aware of the megaprojects advanced supposedly in their names and would sign anything those planners suggested. Such meddling, or the expectation thereof, leads not only to cost overruns but also poor long-term planning, as priorities are shifted based on real or perceived changes in congressional seniority.

Elsewhere, political power is more formal. While Istanbul has total separation between state- and city-designed metro lines, shared responsibility for funding and planning is the norm in Italy and Sweden. In Italy early lines were built municipally, but today the state funds 80-100% and conducts tight supervision on the basis of economic performance while the planning remains local. In Sweden, only the yes-or-no decision over the largest projects, noticeable in the state budget, is political; all other projects compete for state grants on the basis of cost-effectiveness. The idea that a politician should or even could make phone calls to influence the routing priorities or adjudicate conflict over professional issues such as noise concerns is unthinkable. In low- and medium-cost countries, the role of politicians is to macromanage rather than micromanage.

2.3 Civil service and internal capacity

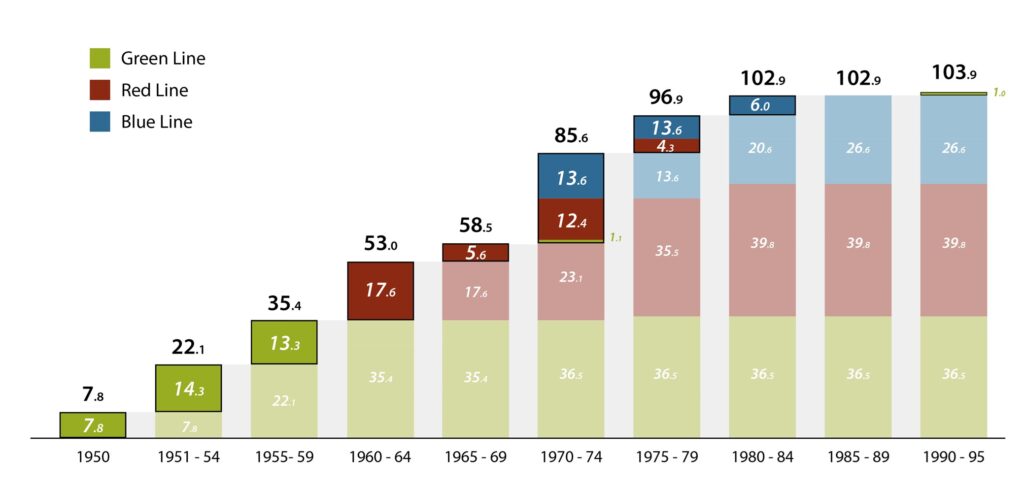

The other side of the coin from politics is the professional civil service. Cities benefit from continuous rail construction through the development of expertise and the growth of the rail industry. The agencies, contractors, sub-contractors and consultants gain experience through years of designing, managing, and building, and they invest in talent, technological innovation, and expensive equipment. A thick ecosystem of contractors also promotes competition; Citybanan and Nya Tunnelbanan are low-to-medium-cost projects built after a generation-long gap in Stockholm megaproject construction, but those have had to rely on ever-larger international firms.

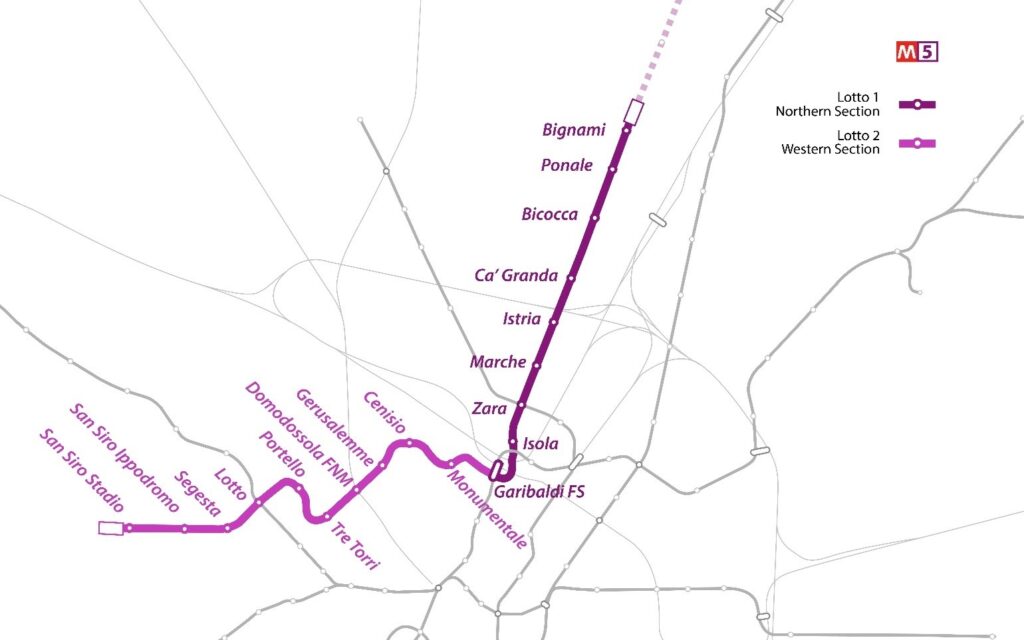

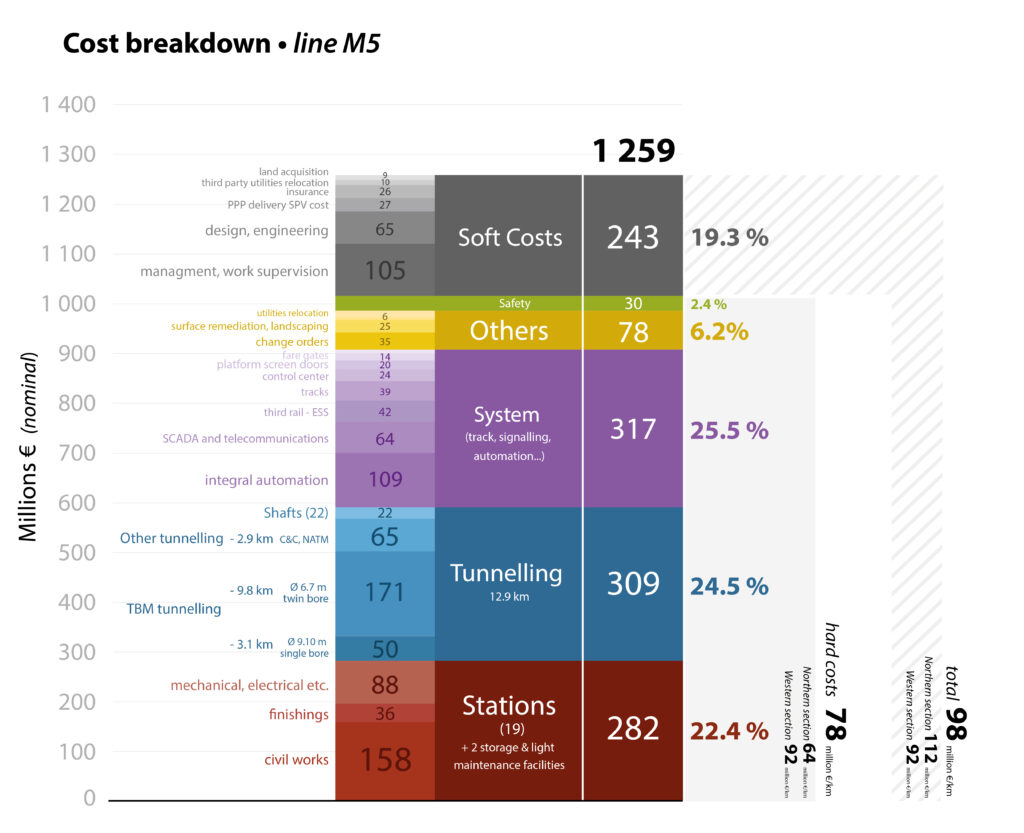

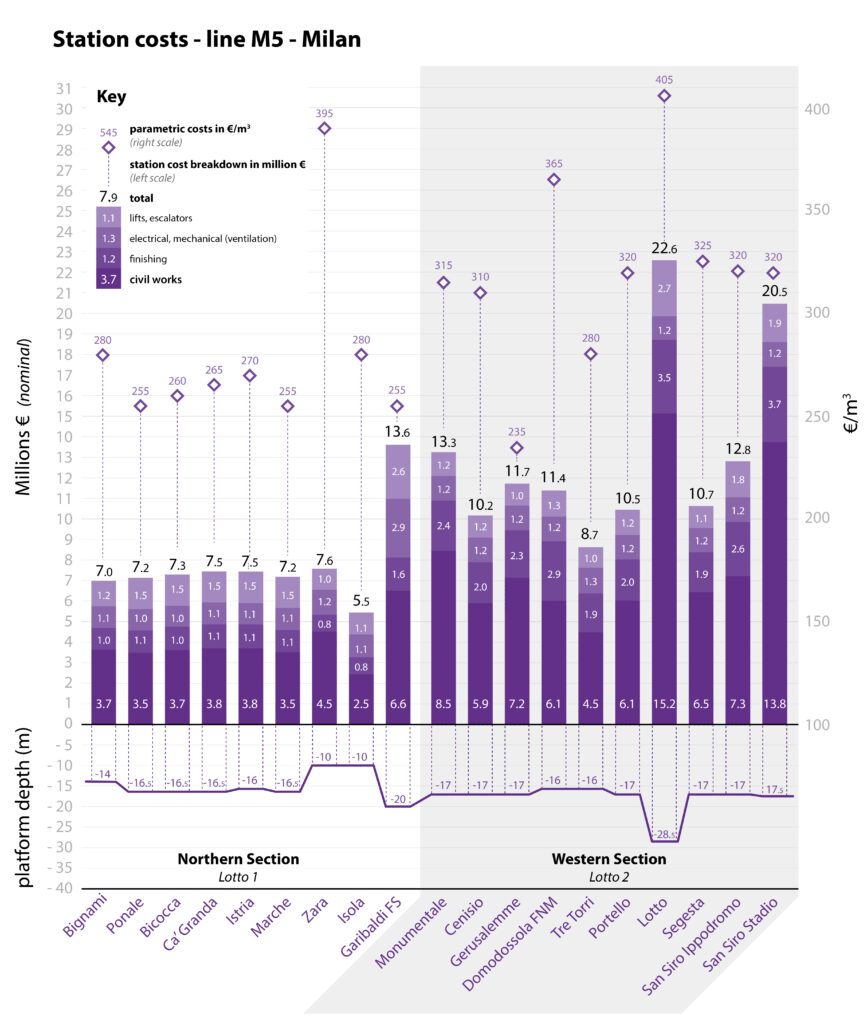

Milan, whose network is soon to reach 110 kilometers, has steadily built urban rail since 1955, and worked with the municipally-owned engineering firm Metropolitana Milanese SPA (MM) throughout its rail construction program. MM is responsible for the planning and design of Milan’s metro network, the tramway network’s modern expansion as well as the cross-city suburban rail tunnel Passante.

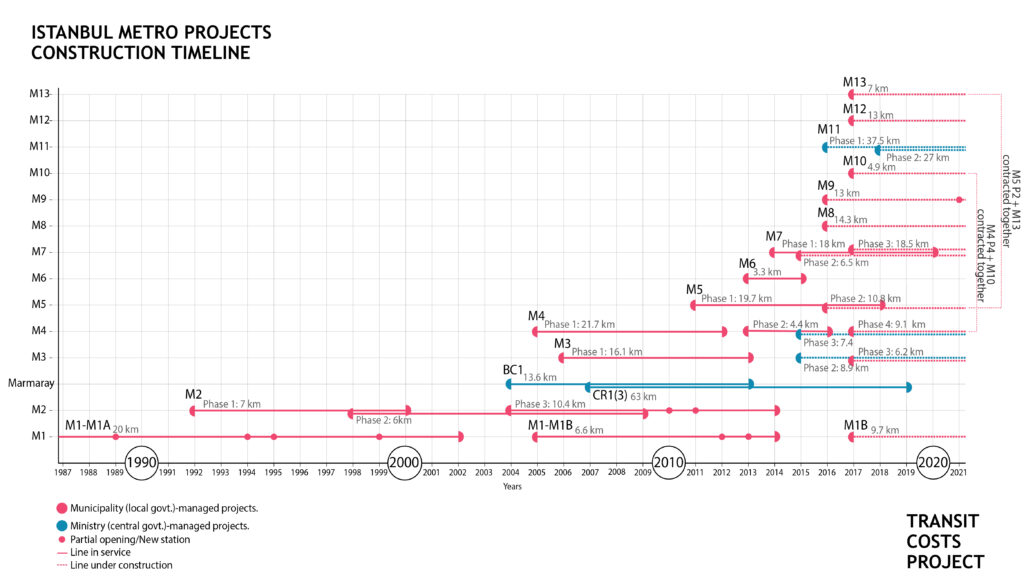

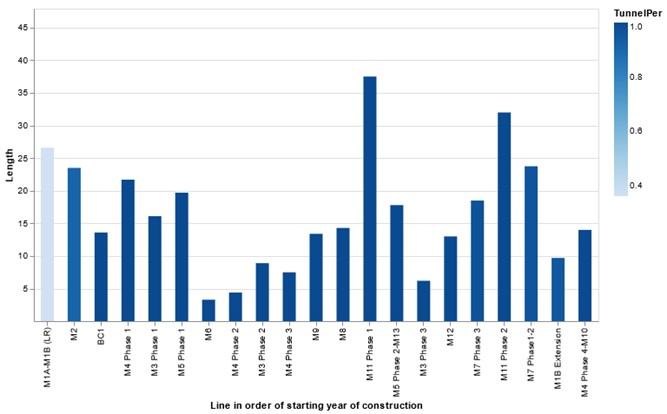

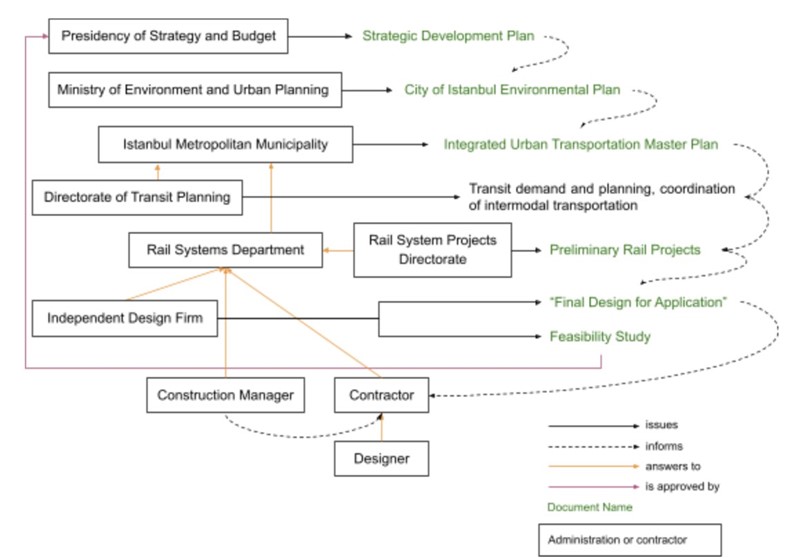

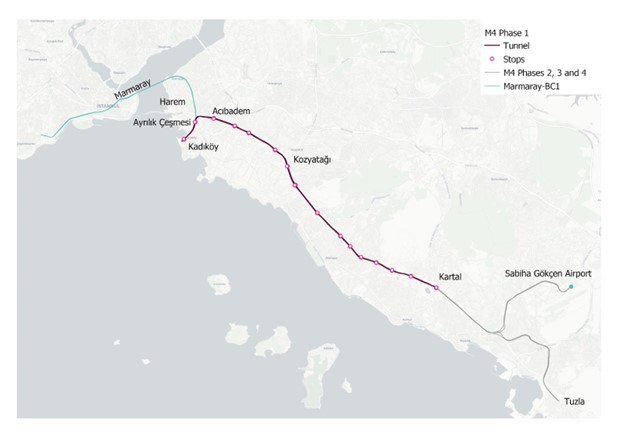

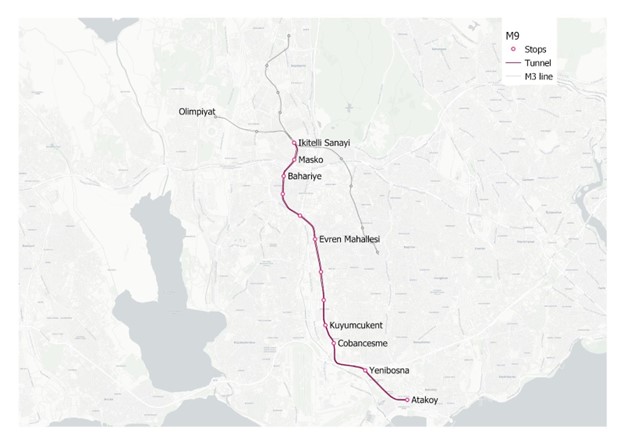

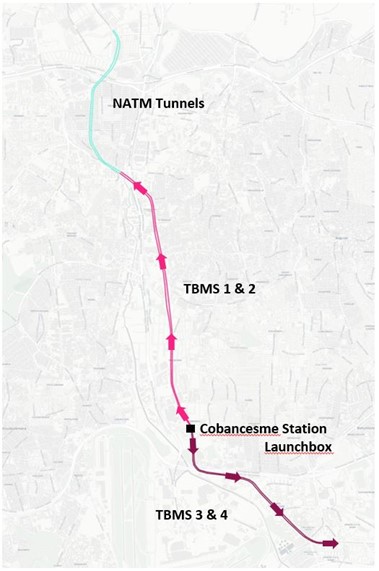

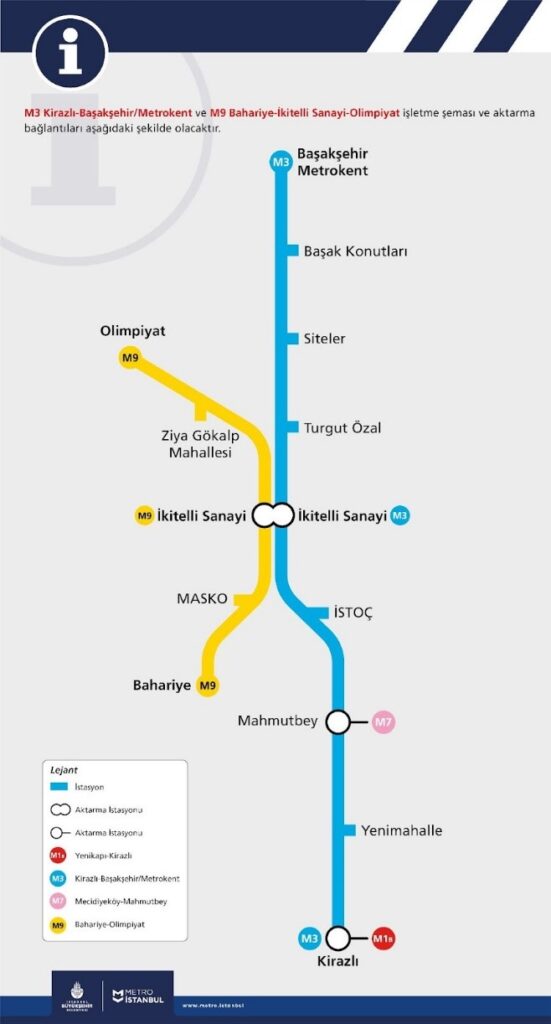

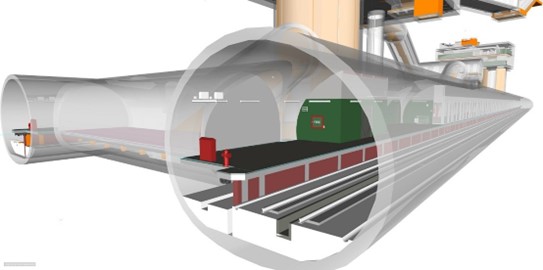

Istanbul has cultivated a rail-construction ecosystem through building and planning 300 kilometers of heavy rail in three decades, in which contractors reared tunneling experts, integrated building information modeling (BIM) into their processes, and developed a prefabricated slab track system that sped up track construction. The collective experience between the city, the consultants, and the sub-contractors was also able to counterbalance the shortcomings of a less experienced contractor during the construction of M9.

In contrast, inadequate internal capacity can mean an agency plans and manages a project with too few staff members with relevant experience, or with a structural organization of teams or departments that impede efficient collaboration and decision making. When agencies lack the internal staff to plan and manage projects, they turn to consultants. During the first iteration of GLX, the MBTA, which hadn’t expanded its network since the 1980s, only had four to six full-time employees managing the largest capital project in the agency’s history. Instead of building a team within the MBTA to shepherd GLX through planning, design, and construction, the agency turned to consultant teams at each stage. When this first version of GLX failed because of growing costs and scope, the MBTA reversed course and hired a dedicated GLX program manager who in turn assembled an internal team focused solely on delivering GLX.

Because few American transit agencies have decades of experience building rail projects, there is no pool of in-house expertise. American agencies from Hawaii to Utah to North Carolina have compensated for this lack of expertise by hiring consultants to deliver rail projects, as teams can be scaled up and down more quickly than in-house staff without worrying about long-term commitments, including public-sector benefits and pensions.

However, our cases show that consultant teams need a client who knows what it wants and is technically competent enough to direct the consultants rather than allowing them to design overly elaborate stations or propose additional studies that don’t advance the project. In our GLX case we saw that when the project scope ballooned and consultants studied project alternatives that were obviously unviable, such as constructing a tunnel under an existing right-of-way, there was no one at the agency to rein in the consultants and direct them effectively. In New York, we were told that consultants were seen as an endless resource to study every challenge that emerged multiple times rather than an expensive, specialized unit hired to execute the MTA’s vision.

In the end, consultants end up getting sucked into the larger political morass rather than eliminating it. Multiple interviews with consultants working on major American projects, as engineers, designers, construction managers, and project overseers, revealed formal and informal pressure to produce outcomes that were or were perceived as favorable to the political system. GLX was under pressure to make the costs appear lower than they were, while the Northeast Corridor (NEC) Future program for high-speed rail was under pressure not to disturb very wealthy suburbs in Connecticut. Where consultants are useful, from a decision-making perspective, is in navigating internal agency dynamics: they are neutral within the intra-agency turf battles. However, if management uses consultants to avoid taking responsibility, then the challenges remain unresolved, and the use of consultants keeps design politicized without building in-house expertise.

Consultants working on French projects have stressed to us that even when agencies employ consultants, there must be ample in-house capacity to manage them well. In New York, where consultants largely designed and managed construction for Phase 1 of the Second Avenue Subway, the project management and design contracts were 21% of construction costs. In contrast, in France the typical range is 5-10%, with 7-8% most common, and in Italy and Istanbul, it is typically 10%. In Spain, mainline rail projects are designed in-house by ADIF, with design costs that are hard to disaggregate as those are long-term civil servants on a salary, but the additional private designs add 5%.

The Italian solution to this issue is to use MM as a public-sector consultant to other Italian cities, such as Naples, Genoa, Syracuse, and Parma; it’s even completed work in Copenhagen, Tehran, Santo Domingo, and Alexandria. Turin and Brescia have both modeled in-house teams on MM as they have expanded their transportation networks. France likewise uses RATP and SNCF as public-sector consultants to smaller cities. In the United States, it is prudent to empower a federal agency staffed with experienced builders of cost-effective urban rail to act as a national consultant to help cities and regions that need assistance.

2.4 Procurement and risk

The importance of a strong, apolitical civil service is most apparent when it comes to ensuring a smooth procurement process. Much of the existing literature discusses cost overruns, and some of its recommendations also apply to reducing costs rather than cost overruns but others do not. For reducing costs, a strong in-house design review team is always required, and formal and informal transparency is critical, both aspects ensure conflict is dealt with quickly and without costly litigation. It is equally critical to avoid privatizing risk, as that leads to higher costs as private contractors inflate bids to compensate for greater uncertainty. Finally, the procurement must be flexible enough to permit designers and contractors to make small changes based on circumstances and learning. Unfortunately, the English-speaking world has adopted a procurement system that, in the Sweden report, we call the globalized system, which reacts to insufficient civil service capacity by privatizing risk to large consultants and contractors. But before we explain what the problem with this system is, we give a descriptive overview of procurement systems.

The three main ways of procuring megaprojects that we encountered in our cases are design-bid-build (DBB), construction manager/general contractor (CM/GC), and design-build (DB). Under DBB, there is separation between design and construction; under DB, the same entity designs and builds the project. Under CM/GC, the general contractor is brought in during the design phase to work with the design team to produce plans that best match their strengths and identify weaknesses in the design before transitioning to the build contractor during construction. It’s worth noting that under CM/GC, the agency ends up owning the design like DBB rather than offloading design risk, as in DB.

There has been a tendency in the last generation to transition to alternative delivery methods like CM/GC and DB, which are viewed in much of the English-speaking world as more modern and flexible because they allow contractors to use their means and methods to develop the designs and techniques best suited to their abilities and equipment to deliver the project. But most low-cost examples do not use CM/GC or DB; it is not used in Spain, Sweden is early in the transition from DBB to DB, and Italy uses a mix of methods but has de facto banned CM/GC. Turkey has used both DBB and DB, and now uses a hybrid system, in which there are two contracts but they are not split as design and construction but rather as 60% design and a combination of 100% design and construction; Italy in practice is similar, except that the threshold is not 60% but 80-90%.

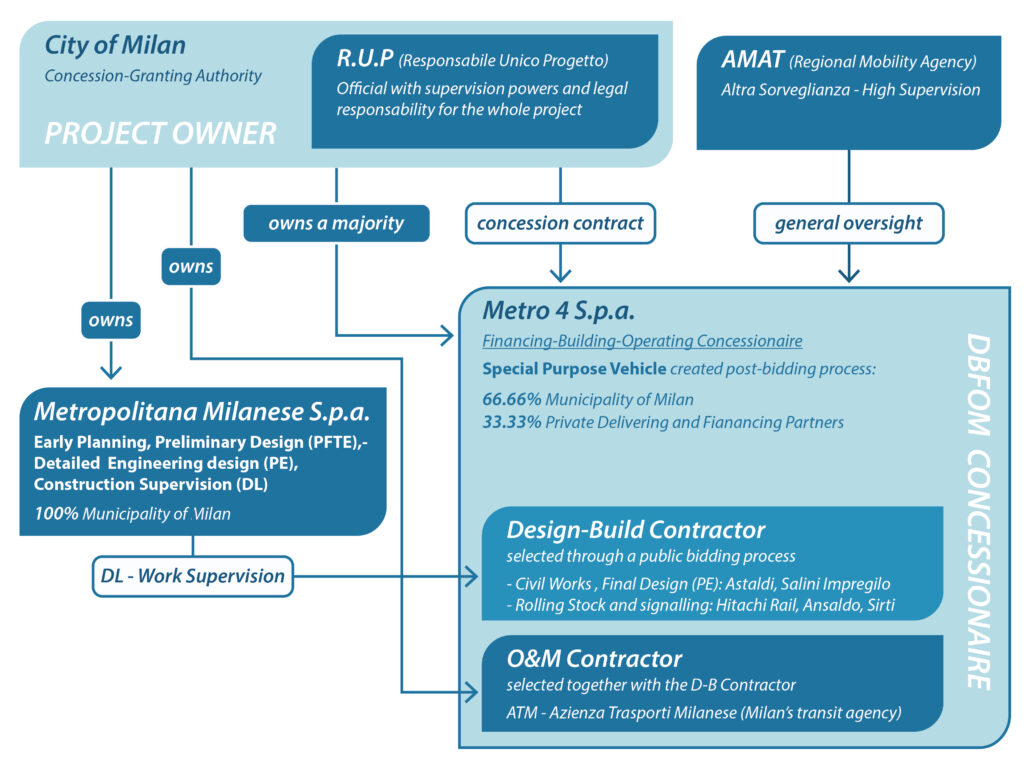

Across our cases, we find that the procurement method matters less than how the process is managed and how competent public oversight is. In other words, what matters is that public agencies are entrusted with the powers and the technical capacity to guide the procurement and delivery process. Public agencies should retain the legal and technical capacity to supervise crucial in-construction decisions, such as major change orders, by having wide access to information and by leveraging in-house technical expertise. In Italy, whenever crucial functions of early planning, construction management and oversight were entrusted to empowered public technical entities, even highly privatized Public-Private Partnerships (PPP) schemes proved to be cost-effective, though the guaranteed concessionaire profits have led to elevated operating costs at high implied interest rates.

Another key element for effective procurement is the level of design upon which RFPs are based: it is critical to avoid rushing the design and spend time on the riskiest elements, such as seismology in earthquake-prone areas, archeology, utilities, and difficult third parties, such as freight railroads in the United States. In Istanbul, as the preliminary design documents improved, the agencies were able to enter the tendering process better informed and had greater command over the project throughout construction. Flyvbjerg and Gardner (2023) refer to this as “think slow, act fast.” There is a tradeoff between working slowly to be more informed and working quickly to avoid having to redesign based on economic changes, and the best approach is to be methodical in the planning stage and fast in the construction stage.

Bid selection is based on either the lowest bid or a combination of price, schedule, and technical merit. Lowest-bid contracts are used for simpler projects or sometimes for simpler aspects of metro lines, such as systems, but rarely for complex civil structures such as metro tunnels. Contractors prefer it this way, since an emphasis on technical quality over price rewards their professionalism instead of a race to the bottom. The weight given to technical merit should be high: 50% in Sweden, 60% in France, 70% in Spain (including speed of construction), and 70-80% in Italy; California has used 30%, which is insufficient for distinguishing the technical soundness of competing bids and in practice behaves like lowest bid. Istanbul exceptionally uses lowest-bid, but the race to the bottom is tempered by three things: the delivery standards enforced by the CM and the agency, the 20% limit for total cost overruns, and the extremely competitive market for contractors.

Without technical scoring or Istanbul’s thick, competitive markets, agencies must use other, inferior mechanisms for quality control. One such mechanism, used extensively in New York, is a lengthy Requests for Information (RFI) process where the agency responds to questions specifying exactly what contractors can and cannot do, down to controlling the materials they use; this is inflexible and increases costs. Contractors throughout the United States call this the agency factor, where the agency can be the MBTA or Sound Transit, or any other large transit agency, and raise their prices by about 20% just for the red tape involved. A more flexible approach requires the agency to have sufficient in-house staff to monitor proposals, in which case they might as well pick contractors by technical merit.

Contracts can be itemized or fixed-price (also called lump-sum). The same international consultants who recommend that DB is more modern also prefer fixed-price contracts; in the Nordic countries this is justified as a way of unlocking private-sector innovation. Instead, complex megaprojects should always be itemized, in order to inform public-sector innovation, increase transparency, and reduce friction in change orders.

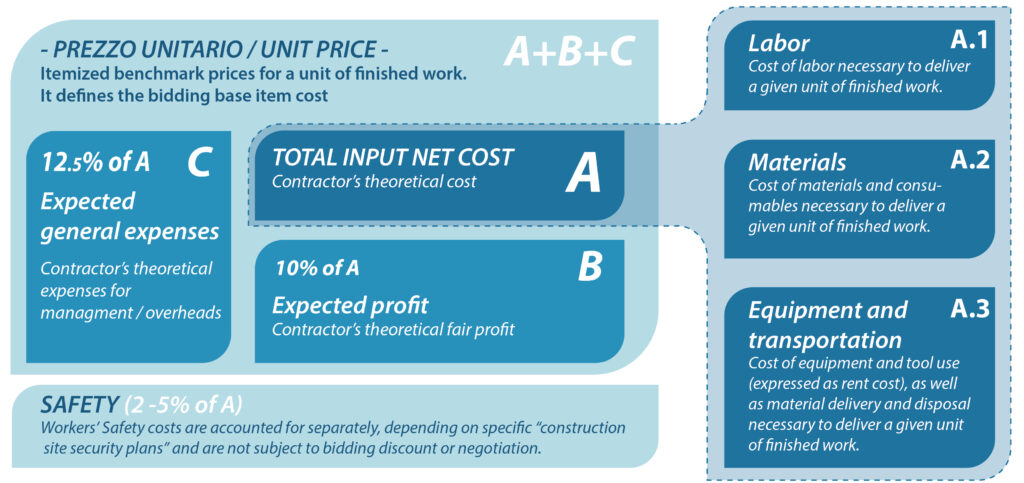

Moreover, the itemized costs must be public. In New York, there are itemized costs prepared by independent cost estimators to inform the MTA when evaluating fixed-price bids, but other than the negotiated wage rates with organized labor, those costs are considered a trade secret of the agency, not to be publicized or else it would interfere with the bidding process. Low-cost countries do the exact opposite: Turkey, Italy, and Spain all use official benchmark unit prices, which have proven to be an important tool for transparency and symmetry of knowledge between the clients and contractors.

The transparency of itemized contracts is especially important for further work on value engineering. To build up their own internal expertise, agencies need to know how much things cost, and the general public and watchdog organizations need to be able to oversee such contracts. In our interviews in New York we realized early that exact comparisons at the level of individual items are impossible, because the data doesn’t exist: the fixed-price contracts do have some itemized breakdowns reported but they’re sporadic and contract packages include multiple deliverables.

Another advantage of itemized costs is that they largely eliminate disputes due to change orders. Ryan (2020) demonstrates that fixed-price contracts for coal plants in India incentivize contractors to lowball their initial bids and then extract more during renegotiation. Likewise, Bolotnyy and Vasserman (2019) find that Massachusetts bridge repair contracts are overall cheaper under itemization because contractors face less risk of escalation in the cost of individual inputs. In mass transit, this has been a recognized if not academically studied problem for a generation, going back to when Los Angeles Mayor Tom Bradley called Ron Tutor the “change order king” in 1992. But Tutor-Perini still gets contracts in California, and change orders remain contentious across the country; in many interviews across multiple American cities, we have been told that contractors make the most money on change orders.

Technical scoring and cost itemization are both especially important for complex megaprojects such as urban subways, which are inherently riskier than roads or regular buildings. Geotechnical surprises are inevitable, and tunnel boring machines need regular maintenance and in practice only operate about 20%-40% of the time.

Spain, Italy, and Turkey are all positive examples. In Spain, an in-house team supervises contractors and approves changes; costs are itemized, so the change is already priced in and eliminates the need to litigate. Turkey approves changes at the construction stage even when they are large, and the contractor that gets the final design and construction contract may still make significant changes from the separate 60% design contract. Since the total cost increase is limited to 20% of the contract value, the agency and the contractor make every effort to balance the change in costs to avoid going over this limit, which would require political approval.

Other places do this less well. Traditional DBB procurement in the Anglosphere as well as in the Nordic countries has been more rigid with regards to changes. In Norway, the rule is that the designer is liable for damages caused by construction if the builder does not make any changes but otherwise the builder is liable; thus, builders avoid making changes, and designers respond with defensive design, trying to anticipate every problem that may arise. American DBB has also been marred by underinvestment in internal capacity—if there are too few design review engineers relative to project size then they will not be able to oversee changes promptly and the project will be stuck.

Regardless of itemization, it is important to keep the risk in the public sector, not the private sector. The private sector compensates for risk by bidding higher, as is common with fixed-price contracts. In the most extreme case, a private contractor can more easily walk away from a stalled project, whereas the public sector cannot due to political embarrassment: the Maryland Purple Line, a PPP designed to transfer risks associated with design, inflation, and utility relocations to the private contractor as trumpeted by Governor Larry Hogan, blew out so much that the concessionaire walked away from the project and collected a $250 million kill fee (Shaver 2020).

Finally, it is important to optimize for minimizing absolute cost, rather than minimizing cost overruns. The deep literature on cost overruns has led agencies to enact changes that improved estimations and reduced overruns; by the 2000s, American light-rail projects stayed on budget, on average (Button et al. 2010). Unfortunately, some of those mechanisms have led to higher upfront costs, such as the private sector’s aforementioned risk premiums as well as higher contingency rates. The use of excessive contingency is especially notable as bad practice. If the money is already allocated in the budget, there is no incentive not to spend it.

This does not mean that tolerance for cost overruns is good. Multiple good planning practices, including itemization to reduce conflict, flexibility about small changes, and avoidance of early commitment, operate by reducing the scope for cost overruns. However, relative costs should not be the only metric used for evaluation, because then contractors have an incentive to bid higher, and then the extra money is guaranteed to be spent.

Overall, we believe that the difference between the best and the worst procurement practices contributes a factor of 2 difference in construction costs. Many different contractors have spoken about how red tape and poor oversight contribute a 15-20% cost premium across American agencies, as noted above. The contentious change order process is harder to quantify; in Ryan (2022) it is said to raise solar power prices in India by 10%. A manager with extensive background in MTA capital construction added, on top of this cost premium, factors related to risk, risk compensation, subcontractor red tape (for example, the Minority- and Women-Owned Business Enterprise rule, or MWBE), and, owing to insufficient competition that sometimes results in one-bid contracts, profit (Personal Interview A 2021); overall, this manager estimates a factor of 2 difference in costs purely due to procurement problems.

Moreover, we believe that, unlike some of the other problems in this report (see below on labor), the procurement problems are not purely American. The globalized system is rife in the English-speaking world; we note that London Underground construction costs were in line with Italian levels and only diverged in the 1990s, when there were massive changes in British procurement reducing the role and expertise of the civil service and (after cost overruns on the Jubilee line extension) replacing it with private consultants. Indeed, the London cost premium over Italy and Sweden is not a factor of about 10 as in New York, but a factor of about 3.

2.5 Utilities and agency coordination

Effective governance doesn’t exist solely at the level of the individual agency. Coordination within and between agencies is unavoidable and critical to managing a project in a built-up urban environment. These can include peer mass transit operators sharing the same right-of-way, but also agencies that control streets, sewage, power, or other utilities. All of these interfaces add a layer of coordination, which is invisible when done right but drives delays and costs when done poorly.

We have repeatedly heard from people involved in the construction of urban rail tunnels in the United States that physically dealing with underground utilities is difficult, and not just in New York but also in much newer and less dense places like San Jose and Los Angeles. Due to ongoing construction and maintenance work, utility lines frequently are added or moved, and utility maps are perpetually out of date; this partially explains why urban tunnels are more expensive than tunnels for intercity rail outside urban areas, and why city center tunnels cost more than metro tunnels in farther out neighborhoods.

And yet, the utility problem is really a problem of coordination with other agencies and utility providers. Italian cities are old and densely populated, too, but have a clear process, the conference of services, that allows each impacted administrative entity to represent its interests prior to construction. In Milan this has gone a step further: thanks to MM’s success in planning and designing transportation infrastructure, the city has given it responsibility for planning and designing water and sewage projects, too. The difference between Milan and New York is not density or the physical state of the utilities; it’s the governing institutions. The Milanese organization, in which the agency that builds metro tunnels also builds other city utilities but does not operate the trains, is a valuable model for improving coordination between utilities.

In American cities, the transit agency is separate from the agencies or companies that own and operate power lines, telecommunications networks, sewage, streets, and parks. What drives costs is the difficulty coordinating across these entities and reaching cooperative agreements that ensure all parties’ needs are met equitably. More often than not, megaprojects with their multibillion-dollar budgets pay for utility upgrades, new street lights, and upgraded pipes in order to buy permission to dig shafts, tunnels, and station caverns. In our Second Avenue Subway case, contractors often complained that the local power utility slowed them down and raised costs by not showing up to power down electrical lines when it said it would even though all entities had agreed to a schedule prior to construction.

In New York, we were told numerous times that MTA Capital Construction needed a sign off from New York City Transit (NYCT), the entity that operates the buses and subways in New York, before starting construction. In New York this meant adding more back-of-house space to stations than was necessary, building more crossovers along the line than were needed because NYCT wanted them (for example, at 72nd Street), and even changing the size of tiles to conform to NYCT standards. In our GLX case this meant adding spaces for MBTA staff at stations and building a larger than necessary Operations and Maintenance facility for the Green Line. By separating capital construction from operations, there are fewer opportunities to get sucked into the internal politics of the agency and design stations and facilities that deviate from international standards.

Across these examples, the key is coordination and boundaries. In terms of coordination across agencies and utilities, clear, unambiguous standards and expectations about utility replacements and street restoration are paramount. If every interaction is unique and requires a new set of negotiations, there are more opportunities for delay and uncertainty. In the case of intra-agency coordination, the same rules apply: the capital construction arm shouldn’t be held hostage by the operating arm. This means that the operations department needs to engage seriously from the outset and determine what it needs and what would be nice to add if budget allows. Taken a step further, perhaps, a complete separation of operations and capital, as we saw in Italy, Sweden, and Istanbul, is the best way to proceed.

2.6 Labor

High-cost, low-productivity labor can substantially raise construction costs. In our American cases, we found that labor costs consumed a greater percentage of construction budgets than in our non-American cases because of strict overtime rules, local union agreements that limit the available labor pools geographically, and an unwillingness to address staffing and labor agreements. In contrast, in our interviews with experts outside of the United States, none mentioned labor as a factor, even in high-cost countries like Britain and the Netherlands.

When we examined the data on labor costs, we found that in New York labor costs reportedly accounted for 40-60% of the overall construction costs. In contrast, labor amounted to 20-30% of the overall cost of construction in Italy, Sweden, and Turkey. Reducing American labor costs to their Italian, Swedish, or Turkish share would cut labor costs by a factor of about 3, and overall project costs by a factor of about 1.5.

Different low-cost countries have different levels of wages, benefits, and worker empowerment. Low-cost Scandinavia is famous for its high union density, extensive use of sectoral collective bargaining, and low inequality. Low-cost Turkey has a non-union construction workforce and few statutory labor protections, which means laborers are paid $12-15 per hour including overheads and social security. Miners in Sweden are paid around $90,000 a year, with a similar amount paid out as benefits including temporary housing, while other workers on a construction site are paid about half as much—and a union analysis from the 2000s found that 45% of megaproject construction workers were temporary or permanent migrants (Jonsson et al. 2014). Contractors we interviewed with experience in both Sweden and Turkey told us that Sweden’s high labor productivity compensates for its high wages.

Tunnel boring machine (TBM) staffing provides a ready-made example of where an unwillingness to address staffing and labor agreements drive costs without improving productivity. During construction of Phase 1 of the Second Avenue Subway 46 workers were employed to operate and support the TBM per eight-hour shift. In addition, there were another 29 management staff who oversaw construction over the course of the day. In our interviews, we were told that staffing and supporting the TBM could have been done with 30 workers per eight-hour shift and that the number of supervisors exceeded international norms (Personal Interview B 2021).

And yet, the overstaffing in the United States is not a purely blue-collar phenomenon. Much of the premium comes from white-collar overstaffing: in our GLX case, we found that during the first iteration of the project, the ratio was estimated at 1.8 craft laborers to 1 supervisor by the CM/GC. In New England, the expected ratio is 2.5 or 3 craft laborers per supervisor; thus, GLX had 40-60% more supervisors than is normal in the Northeast. In New York, each agency insists on having its own on-site supervisor. For example, Con Ed requires its own workers to handle electric utilities, and this is counted as additional staffing for what is really an interagency turf battle.

But this does not mean that the unions are blameless in New York. There, they raise costs due to three quirks of American labor relations.

The first quirk is that the American labor tradition has rigid overtime rules. In New York, tunnel workers doing weekend work get paid double their standard hourly rate. This is so lush that senior workers often deliberately seek out jobs paying extensive overtime. In contrast, French overtime is only 1.25-1.5 times normal pay and capped at 10 total hours a day and six days a week to prevent overwork. Swedish miners do not receive overtime. This applies to operations as well: American transit workers pick their shifts in order of seniority with an overtime formula, whereas German and Swiss workers are scheduled centrally according to a system that ignores seniority and aims to spread the least desirable shifts (such as night shifts) equally among workers.

The second quirk is that American labor is local. Railway workers and construction workers in Europe are nationally mobile and often mobile across the entire EU. Spanish rail maintenance workers move between different parts of the country, staying in temporary worker housing wherever they are posted to. So do tunnel miners in Sweden; many are EU migrants, and on Nya Tunnelbanan none is a native Stockholmer. No such thing occurs in unionized American labor: the tunnel workers and operating engineers in New York are rooted in the region and only work within or right next to the city.

The mobile system has its own costs. Fringe rates are high because of the need to provide temporary housing: they add 100% to the cost of a Swedish worker, a comparable rate to that of a unionized New York tradesperson, American unions having unusually high fringe rates due to high-cost health plans. However, a nationally mobile workforce is a more productive workforce–such workers gain experience from tunnels built elsewhere, whether for infrastructure or for the mining of natural resources. Present-day New York laborers only have experience with New York projects; thus, they are a dedicated and driven workforce but also a low-productivity one, having never seen more efficient tunnel projects.

The third quirk is that among politicians, the mentality is that unions are a veto point rather than one additional interest group that they can accommodate or overrule based on circumstances. Thus, politicians are reluctant to force unilateral changes (such as eliminating the supernumerary positions among laborers or working to bring in outside workers); the view is that any change has to be a negotiation. This way, if there’s any conflict, the default solution is to change nothing, and this way, work rules can stick for generations even as labor-saving technology develops and wages rise.

2.7 Cost-effective design

Differences in design drive large differences in costs, particularly for stations. As before, the real questions are institutional, and there, three key principles emerge. First, agencies that follow consistent national or international standards for design and construction build projects cheaper and quicker than agencies that turn to bespoke solutions for every project element. Second, cities should be willing to tolerate somewhat more surface disruption to get construction done more quickly. And third, agencies that prioritize value engineering and in particular build right-size stations using conventional techniques have lower station construction costs than those that mine palatial stations with plenty of excess space.

Standardization reduces design and soft costs. For underground stations, this typically includes systems such as standardized elevators, ventilation facilities, and mechanical rooms. This way, design costs can be shared across stations within a project and across different projects in the same city, to take advantage of economies of scale. Standardization also enables agencies to learn as they go and apply lessons intelligently to speed up construction, reduce costs, and avoid future mistakes (Flyvbjerg 2021; Eno n.d.).

Italy uses international, European Union, and Italian standards for station fittings. This coexists with high levels of flexibility in contracting as mentioned above under procurement: the components are standard, but if variations from the design are needed based on unexpected tunneling surprises or changes in material costs, builders can still make changes. In Copenhagen, designers told us that the stations were 70-80% standardized (Personal Interview B 2022). But the United States has little such standardization: each Second Avenue Subway station and the stations in the initial iteration of GLX were unique, to the point that even the escalators in the three newly built stations in New York were manufactured by different companies.

Scale is important for much more than just subway stations. Inherently cheaper items such as at-grade construction and systems have unusually high design costs if they are bespoke. Thus, in Boston, it costs $20-25 million to build an above-ground commuter rail station, of which $2-7 million come from one-time design costs. The United States has also so far not used any of the standardized European or Japanese modular rolling stock, but instead either customizes trains or reuses obsolete designs that vendors no longer build.

Standardized stations do not have to be spartan. Station design in Stockholm and Helsinki is standardized, but the finishes are aesthetically pleasing, and stations have unique art installations. Stockholm achieved this historically while building the T-bana for $3.6 billion in 2022 dollars, about one-fifth the per kilometer cost of the contemporary Washington Metro, whose stations are uniformly brutalist.

But it’s not enough just to standardize. The standard design must be itself economical, which means stations as shallow as possible based on the chosen construction technique; shallow stations are also better for passengers because they minimize station access time. Standardizing around very deep mined stations hardly saves money or time, nor does it produce the best final product for passengers.

In practice, cost-effective design requires cities to be willing to disrupt the street during construction. The tradeoff is that tunnels can be built by shallow cut-and-cover or by deep mining with a TBM or (rarely) with drilling and blasting; cut-and-cover is cheaper but more disruptive, as the entire street is dug up, and therefore is almost never used today. Vancouver’s Canada Line, a rare modern example of cut-and-cover construction, faced lawsuits from store owners along the street, some resolved only in 2020, 11 years after the line opened; as a result, Vancouver is building the Broadway subway by bored tunnel (Britten 2020).

The usual compromise between the surface disruption of cut-and-cover and the high costs of deep construction is to build cut-and-cover stations but bore the tunnels between; this localizes the disruption to areas that will derive the most benefit from the opening of the line. Expensive projects’ costs are largely tied up in stations, and even medium-cost projects like Helsinki’s Länsimetro Phase 2 pay more for stations than tunnels.

Mined stations are an option as well, but cost more. The two mined stations of Second Avenue Subway cost on a per-volume basis 1.5 times more than the cut-and-cover 96th Street Station. Stockholm has long used mined stations, but in Oslo, the use of mined stations is one of the reasons the Fornebu Line cost $330 million per km compared with $110 million per km for the Løren Line, whose sole station was built cut-and-cover.

Station entrances are uniquely challenging, regardless of construction technique, because entrances are where the project meets the built environment; thus, choosing appropriate sites for both worker access and passenger access and egress is critical. City parks and squares are ideal for this because they are unbuilt upon and are usually municipally owned and don’t necessitate costly and time consuming condemnation processes. Paris, Berlin, Stockholm, and Istanbul all use public parks and plazas to site entrances, and the last three often use this to break up mezzanines into smaller cut-and-cover excavations even if the platforms are mined (as Berlin’s underwater Museumsinsel station is). Milan used city center plazas when it built M1, but could not keep doing so as it ran out of good sites in its Renaissance core. Helsinki uses shopping centers for access.

In New York, the street grid is such that the best location for station entrances is the street and the sidewalks, as at the older stations. This requires some willingness to do street closures during construction. But not only was Second Avenue Subway forced to keep the street open for traffic during construction (in Sweden, roadway disruption is acceptable but not sidewalk disruption), but also it spent extra money to avoid disruption. The TBM launch box included a chamber for storing muck overnight, since overnight trucking was banned even though the TBM operated continuously. Such extra infrastructure interacts with high labor costs, since the daytime-only trucking, when traffic is the worst, tripled the number of required trucks; overall, between the chamber and extra labor costs, the excess cost was $20-30 million.

A final potential construction technique is to put the station inside the bored tube. This can be done if the platform is narrow enough to fit in an ordinary bore, as is the case for some of the recent Italian metros. Alternatively, both tracks and platforms can be put in one large-diameter bore, usually measuring 12 meters or more. This method, called the Barcelona method after its use in Barcelona L9, is controversial: L9 suffered a large cost overrun, making it Spain’s most expensive metro; and yet, some experienced engineers believe it can work for metros, based on its success in Japanese and Turkish high-speed rail tunnels. The tradeoff of the Barcelona method is that the building settlement risk is extremely high, which is why it was rejected in historically sensitive parts of Italy, but there is little need for any cut-and-cover or mined infrastructure, making it perhaps useful in city centers with complex underground metros but also wide enough streets that the building settlement risk can be mitigated.

Finally, it’s critical to limit the extent of the station dig to the smallest box required for the station. As with standardization, the result of good design is not cramped; there must always be sufficient space for passenger circulation. Unfortunately, some North American cities build the stations not just too deep but also too long, housing back-of-house space in the dig at high cost.

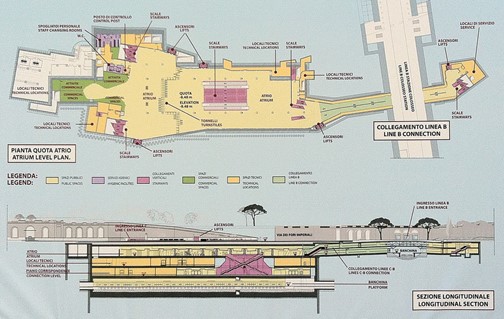

French, Swedish, and Italian subway station digs are barely longer than the trains they intend to serve; an excess of 5% is typical, and 20% is high. But Second Avenue Subway’s mined 72nd and 86th Street stations are, respectively, 400 and 300 meters long, where the platforms are only 187 meters long; the extra length of 72nd over 86th comes from unnecessary crossovers. The rest of the extra volume in these station boxes was given over to back-of-house spaces for mechanical rooms, fan rooms, plenums for the air tempering system, and offices, work stations, and changing areas for signal maintainers, elevator and escalator repair teams, train crews, and other MTA user groups. Where European cities build back-of-house spaces in the area above the platform, New York builds a full-length mezzanine above the platform for passengers and then builds back-of-house areas beyond the platform.

The American design tradition of full-length mezzanines goes back to 1930s New York and has never been value-engineered away. New York’s large cost premium over Paris and London goes back to that era. Engineers and designers that we spoke to about Second Avenue Subway repeatedly cited the need to evacuate stations in six minutes, per fire code requirements, as a justification for full-length mezzanines, when the same fire codes are used in Turkey and (with light modifications) Spain without this feature.

2.8 Recommendations

It is possible to realign institutions and norms in American cities to build urban rail at costs that approach what we have found in low-cost examples like Spain, Italy, Turkey, and Sweden and medium-cost ones in France. We believe the most important development should be to empower entities that build transit projects to realign regulations and practices with what is found across as wide a net as possible of low-cost cities.

To affect such realignment, it’s necessary to cultivate champions who will build long-term public-sector expertise in innovative construction and management techniques, even in the face of public and political scrutiny. All of the following changes are required toward that goal:

- Find champions who will advocate for the project, help with intergovernmental agreements, hold agencies accountable for budgets and schedules, and support agencies if there is political controversy. But the champions need to macro- and not micromanage: their role is to encourage expert civil service plans rather than supplant them.

- Import experts from abroad to get a new perspective on how to do things. Adopt standards that have been tried abroad rather than limiting options to what has been tried in America. Develop long-term connections with peer agencies, including exchange programs, data sharing, hiring and promoting people who speak the language and have the required connections, and participation in global conferences and symposia. Moreover, the people who get to travel abroad for such conferences must not be just senior management, but rather junior and mid-level planners who are eager to develop themselves; the role of leadership is to support the knowledge of junior staff and not to micromanage.

- Collaborate and work with agencies in the same city or region, particularly utilities if they are not all under one roof. It is necessary to ensure that utilities work with transit agencies to provide clear, up-to-date information about their infrastructure so that construction schedules aren’t needlessly delayed once contractors begin construction. There should be staff members within each agency with the permanent portfolio of interacting with their counterparts at peer agencies.

- Foster a culture of transparency, in which information concerning infrastructure maps, blueprints, itemized costs, and public contracts is available to the public, in easily readable forms. The information should be proactively available, without subjecting members of the public to the red tape of freedom of information requests.

- Staff up internal permanent positions, with funding out of regular appropriations and don’t rush to get outside money first. If a region chooses to increase the scope or speed at which it builds infrastructure, as Boston did for GLX and may in the future for the Regional Rail program and as Paris did for GPE, it should proactively staff up in-house. It’s critical to have well-thought-out plans in advance for when money becomes available, to prevent problems of politicization and early commitment, for three reasons. First, to be able to oversee all contracts as well as consultants if they are used. Second, to prevent a GLX-style panic and the costs associated with restarting the project. And third, to make sure that what the planners learn during the project can be folded into the agency’s permanent in-house knowledge base.

At the federal level, it would be wise to empower an agency, perhaps within the FTA or FRA structure, to hire experienced builders of cost-effective mass transit and act as public-sector consultant. In addition to providing assistance, this same agency could also supervise grant applications, with enough staff to ensure fast turnarounds.

Moreover, the entire procurement process must be reformed, and medium-cost countries that believe that the British model is more advanced must cease adopting the methods of such a high-cost country. Instead, the procurement process must be based on the principle of public-sector expertise, with an in-house engineering team that is competent enough to do planning and design. The best practices in procurement are as follows:

- Use either DBB or DB delivery, but if DB is selected for a complex project, the contractor should be involved early to identify the most pressing risks. For a DBB project, the construction contractors should be empowered to make small changes to the design, and this should be codified by only doing the design up to 60-90% so that the construction contractor can make final decisions. In either case, there must be ample in-house expertise to supervise the contractors.

- Itemize contracts with publicly-reviewable itemized costs, and avoid fixed-price contracts.

- Ensure the change order process is flexible and lawsuit-free, anchored by the itemized contract, with an allowance for a mid-project change in itemized costs due to changes in market wages or global commodity prices. This requires a substantial in-house design review team to respond to change orders quickly, and may not be compatible in the long run with the pure client model that the Nordic countries wish to transition to under British influence.

- Keep the risk in the public sector. Requiring the private sector to own all of the risks just leads to higher bid prices, without reducing the risk of major cost overruns; this interacts with itemized change orders, since the itemized contract anchors a price that the public client has to pay.

- Award contracts based on technical merit and not just price. The technical score’s share of the overall award decision should be at least 50%, and possibly 60-70% or higher.

- Standardize regulations to ensure that national and international contractors can understand and comply with them without having to hire local bundlers or subcontractors. Unique state regulations, for example MWBE in New York, reduce the ability of outsiders to break in and compete in the domestic market.

- Limit contingencies: high contingencies, sometimes going up to 40-50%, just end up getting absorbed into the budget with little benefit. It’s more important to control absolute costs than to control cost overruns; in the United States, cost overruns have been uncommon since 2000, but absolute costs are very high. Additionally, for projects that are broken up into phases, contingencies should decrease between phases as lessons learned and actual costs shape future phases.

Finally, the design must be cost-effective. Value engineering must be proactively integrated into every project, and this is especially important for the construction of stations, since the differences in costs between different cities are more in the stations than in the tunnels between them. All of the following principles are critical:

- Standardize designs so that they can be repeated between different expansion projects, without the urge to tweak the design every time based on small changes in taste or law. Tweaks should only be done based on local physical conditions, such as the shape of the street network or surrounding infrastructure, and lessons learned during construction.

- Use cut-and-cover infrastructure whenever possible, especially for stations. Mined stations can be cost-effective but only in very hard rock or in extremely sensitive archeological environments, and large-diameter bores are only viable if all platform infrastructure can be put inside the bore and if the line has to weave around many older city center subways. To support this, the stations should be built as shallowly as possible based on surrounding infrastructure and, if the tunnels between them are bored, the minimum bore depth.

- Build simple station boxes, with little more space than is required for passenger circulation. If employee space is required, it should be placed around circulation space, on spare platform width, or above ground, rather than in dedicated spaces that increase dig volumes.

3. The Boston Case

The Story of the Green Line Extension

3.1 Why the Green Line Extension?

Boston and its Green Line Extension (GLX) project form the first of six case studies that we are tackling in order to understand how one can build public transportation more efficiently and less expensively. When choosing cases, we looked for a number of different variables to avoid drawing general conclusions from sui generis examples. These included the following:

-

- For the first American case, we wanted to avoid New York. The reason is that while American costs are generally high, New York’s are uniquely high, and therefore it is likely New York has an unusual set of failures not seen elsewhere in the country.

- Capital construction costs in Massachusetts have exploded over the last 40 years. While there hasn’t been any expansion of the existing network since the 1980s, we see in Table 1 that even after adjusting for inflation, GLX is only 6% cheaper per kilometer than the Red Line extension to Alewife, which is entirely underground and has deep, cavernous stations. The Orange Line project may be a better comparison because the majority of the project was at-grade, with a short tunnel under the Charles; GLX, without any tunneling, is more than twice as expensive per kilometer.